Trade the Pool Review with Rankings 2024 By Dumb Little Man

By John V

January 7, 2024 • Fact checked by Dumb Little Man

| Evaluation Criteria |

|---|

The specialized team at Dumb Little Man, renowned for their finance and trading expertise, conducts thorough assessments of proprietary trading firms. Utilizing a detailed algorithm and stringent evaluation criteria, they prioritize critical aspects for in-depth analysis, including:

Their assessment of Trade the Pool highlights that the firm not only meets but surpasses these fundamental benchmarks. With its profound knowledge of the brokerage industry and unwavering trader support, Trade the Pool emerges as a top-tier prop trading firm. |

Companies that trade stocks, currencies, and other financial assets using their own money are referred to as “proprietary trading firms” or prop firms. These companies attract both seasoned and novice traders since they allow traders to use the firm’s funds for trading.

Trade The Pool, developed by Five Percent Online Ltd., is a noteworthy introduction in this industry. The5ers.com, a well-known brand in online proprietary trading since 2016, is also owned by this company.

This post provides a review of Trade The Pool by fusing real user reviews with analysis from Dumb Little Man’s trading specialists. The evaluation combines professional judgment with actual user experiences to provide a comprehensive viewpoint. It seeks to give readers an easy-to-understand and thorough understanding of Trade The Pool so they may make wise decisions when trading proprietary.

What is Trade the Pool?

Created by Five Percent Online Ltd., Trade The Pool (TTP) is a stock trading prop firm. Since 2016, this organization—which is in charge of The5ers.com—has earned a solid reputation in the online prop trading space. Trade The Pool makes use of this knowledge to offer a dependable stock trading platform.

The crew at the firm, which is made up of seasoned active traders, approaches the market with a wealth of knowledge. These experts have direct experience in a range of trading capacities, which has shaped TTP’s dedication to a rewarding trading environment. This useful information is consistent with The5ers’ standing as a pioneer and innovator in online prop trading.

With a focus on mutual benefit, TTP’s funding program cultivates a partnership-centric connection with its stock traders. As pioneers in the online prop trading sector since 2016, Five Percent Online Ltd highlights ethics and transparency in a largely unregulated industry. Their commitment to these principles has fostered trust among partner traders.

To reinforce its ethical stance, Trade The Pool, through Five Percent Online Ltd, has established a public ethics memorandum. This document signifies their dedication to integrity and ethical practices, especially important in the unregulated realm of online prop trading. Trade The Pool stands out as a trading platform and a trustworthy and ethical trading partner.

Pros and Cons of Trade the Pool

Pros:

- Variety of account types

- Wide range of trading options

- Multiple customer support channels

- Structured risk management

- Automatic position adjustment at day’s end

Cons:

- Limited customer support hours

- Strict withdrawal rules

- Risk of account termination

- Tough evaluation for funding

- Limited in-house educational resources

Safety and Security of Trade the Pool

Prop trading firms like Trade The Pool emphasize safety and security in their operations, a key aspect thoroughly examined by Dumb Little Man. This proprietary trading firm, also known as the “Company” or “Owner,” is integral to an Online Funding and Growth Trading Program managed by Five Percent Online Ltd.

Incorporated in the United Kingdom, this company holds the registered UK Company number 12553363 and is an extension of Five Percent Online LTD (Israel) with company number 515864007 / LEI: 894500CK24MUEFQG0E92.

The operations of Five Percent Online Ltd are firmly under the laws of the United Kingdom, ensuring strict legal compliance and security standards. With its official address at Enstar House, 168, Praed Street, London, United Kingdom, W2 1RH, the firm’s established physical presence in a recognized jurisdiction highlights its commitment to a secure and dependable trading environment.

This location in a reputable area like the UK further reinforces Trade The Pool’s dedication to offering a safe and trustworthy platform for its clients.

Trade the Pool Bonuses and Contests

As of right now, Trade The Pool is not running any promotions or competitions. Traders and other interested parties should continue to be on the lookout for new opportunities. The site frequently makes changes to its selection, so it’s a good idea to check Trade The Pool periodically for new bonus offers and competitions.

Trade the Pool Customer Reviews

Trade The Pool’s 4.5-star rating on Trustpilot, which is deemed mediocre, currently reflects the mixed evaluations left by customers. Refund requests have been made after certain users voiced their displeasure, citing problems with limit orders in premarket trading and worries about dishonest tactics in prop businesses.

Some reviews, on the other hand, hail Trade The Pool as the greatest prop firm for small-cap stock shorting, emphasizing the benefits of remote trading during extended market hours and the opportunity to trade without putting personal money at risk. They praise its approach to managing risks and the special chances it offers day traders.

Trade the Pool Commissions and Fees

Trade The Pool implements a straightforward commission and fee structure for its traders. The minimum commission is $0.75 or 1/2 of a cent per share. For example, buying 50 shares of AAPL incurs a cost of $0.75, while purchasing 200 shares costs $1. This pricing is designed to be simple and accessible for traders of all levels.

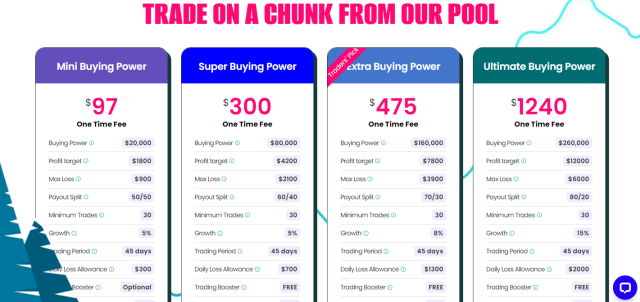

In addition to the commission per share, Trade The Pool offers different levels of buying power, each associated with a one-time fee. The Mini Buying Power option costs $97, while the Super Buying Power is available for $300. For traders seeking more leverage, the Extra Buying Power comes at $475, and the Ultimate Buying Power requires a one-time fee of $1240.

Trade the Pool Account Types

Based on extensive research by our team of experts at Dumb Little Man, the following are the account types offered by Trade The Pool:

Mini Buying Power

- One Time Fee: $97

- Buying Power: $20,000

- Profit Target: $1,800

- Max Loss: $900

- Payout Split: 50/50

- Minimum Trades: 30

- Growth: 5%

- Trading Period: 45 days

- Daily Loss Allowance: $300

- Trading Booster: Optional

- Real Time Market Data: FREE

Super Buying Power

- One Time Fee: $300

- Buying Power: $80,000

- Profit Target: $4,200

- Max Loss: $2,100

- Payout Split: 60/40

- Minimum Trades: 30

- Growth: 5%

- Trading Period: 45 days

- Daily Loss Allowance: $700

- Trading Booster: FREE

- Real Time Market Data: FREE

Extra Buying Power

- One Time Fee: $475

- Buying Power: $160,000

- Profit Target: $7,800

- Max Loss: $3,900

- Payout Split: 70/30

- Minimum Trades: 30

- Growth: 8%

- Trading Period: 45 days

- Daily Loss Allowance: $1,300

- Trading Booster: FREE

- Real Time Market Data: FREE

Ultimate Buying Power

- One Time Fee: $1240

- Buying Power: $260,000

- Profit Target: $12,000

- Max Loss: $6,000

- Payout Split: 80/20

- Minimum Trades: 30

- Growth: 15%

- Trading Period: 45 days

- Daily Loss Allowance: $2,000

- Trading Booster: FREE

- Real Time Market Data: FREE

Opening a Trade the Pool Account

Trade The Pool offers an easy-to-use account opening method that is both quick and effective. This is a comprehensive how-to tutorial to help you get started in trading.

- Go to the website of Trade The Pool.

- Select the account type that you want.

- Select “Start Trading”.

- Enter your personal data here.

- Read the terms and conditions, then agree to them.

- Send in any documentation needed for verification.

- Finish the selected account’s payment.

- Await receiving confirmation of account activation.

Trade the Pool Customer Support

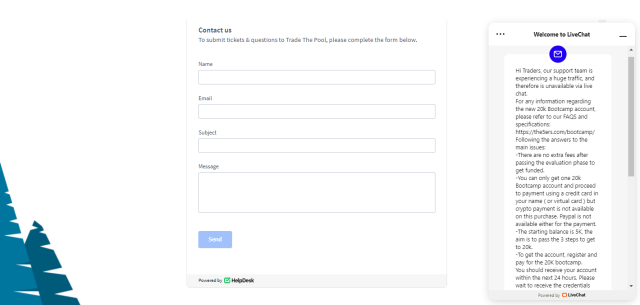

Based on the experience of the Dumb Little Man team, Trade The Pool’s customer care system provides multiple avenues for customers to receive assistance. They guarantee a decent window of availability for international traders with their office hours, which are 07:00 – 17:00 GMT on Sundays through Thursdays and 07:00 – 12:00 GMT on Fridays.

Customers can contact [email protected] via email with any questions or concerns. Additionally, using the form on their website to submit questions or issues is an easy method to address specific concerns.

Trade The Pool also offers a live chat for immediate assistance, improving the speed of their customer support. Their website includes a detailed FAQ section, answering common questions and providing quick access to essential information.

Advantages and Disadvantages of Trade the Pool Customer Support

| Advantages | Disadvantages |

|---|---|

|

Trade the Pool Withdrawal Options

Based on testing by a trading professional at Dumb Little Man, Trade The Pool offers specific withdrawal options for its traders. The Fund allows traders to receive their share of net profits upon request, but this can only be done a minimum of 14 days after the last payout, or for new traders, since the commencement of funded trading.

Traders can only take their winnings out of the current payment cycle if they have made at least $300 in profit. This cutoff point guarantees that traders have significant gains before cashing out.

An important condition to note is the account termination policy related to profits and drawdowns. For instance, in the Super Buying Power level, once a trader reaches thrice the Daily Loss (DL) in profit, the maximum drawdown for the account is reset to $0. Withdrawing the entire profit amount at this stage would result in account termination.

The trader must make sure that, following any withdrawal, their account balance is greater than $0 in order to continue trading. The goal of this strategy is to incentivize traders to extend their trading window and accumulate a buffer.

Trade the Pool Challenges and Difficulties

Trade the Pool as a Funded Trader, traders must double their maximum drawdown as stipulated by the Pool. To secure a funded account, for example, $4200 in profit must be made against a maximum drawdown of $2100. There is a thirty-trade minimum requirement and a thirty percent daily loss limit per trade for risk. Strict risk management is in effect.

One important requirement that must be fulfilled to prevent account termination is the Max Drawdown. A wide variety of stocks and exchange-traded funds (ETFs) are available to traders in the U.S. markets. Throughout the 45-day Trading Period, day trading and overnight position holding are allowed, including pre-and after-market hours.

Trade The Pool’s End of Day function automatically adjusts positions five minutes before market close to maintain overnight exposure constraints, ensuring traders stay in compliance without requiring user intervention.

How to Pass Trade the Pool Evaluation Process

Successfully navigating Trade The Pool’s evaluation process requires a strategic approach due to its demanding criteria. For individuals aiming to succeed, it’s crucial to be thoroughly prepared with the necessary knowledge and skills.

Engaging in a detailed training program is key to this preparation, providing you with the tools and understanding needed to effectively pass the evaluation. This step is vital in ensuring that you’re not just entering the process, but doing so with a well-equipped and informed strategy.

Asia Forex Mentor – Rated Best Comprehensive Course Offering by Investopedia

Trading experts at Dumb Little Man highly recommend Asia Forex Mentor for individuals who are serious about passing Trade The Pool’s challenge. Thousands of traders have benefited from this platform’s assistance in navigating prop company evaluation systems.

Ezekiel Chew, a well-known forex trading specialist with more than 20 years of expertise and a track record of making six figures each trade, launched Asia Forex Mentor.

The exclusive One Core Program was created especially to train forex traders by Ezekiel, who is also the leader of the Golden Eye Group. The main goal of this curriculum is to educate trading techniques for successful forex trading.

Giving trading lessons to close friends was Ezekiel’s first step in starting Asia Forex Mentor. From there, it went online. His trading success is clear, and he provides his wealth of information, expertise, and experience through Asia Forex Mentor in order to help others succeed in the forex market.

How Could Asia Forex Mentor Help You Pass Trade the Pool Challenge?

Asia Forex Mentor is an exceptional resource for anyone wishing to pass Trade The Pool’s challenge due to its exceptional reputation and proven track record of success in teaching forex trading.

Awarded for Comprehensive Course Offering: Investopedia—a reputable Asian source of financial information—ranks Forex Mentor’s One Core Program as the best Forex school overall. The program’s breadth and depth are highlighted by this award, which makes it an excellent option for in-depth teaching.

Recognized as the Best Forex Trading Course: The course was ranked as the best Forex trading course for beginners by Benzinga, a trustworthy source for stock, business, and financial news. The course is highly recommended by Benzinga, indicating its suitability for both inexperienced and seasoned FX traders.

Best Forex Mentor Recognition: BestOnlineForexBroker recognized Asia Forex Mentor as the best forex mentor of 2021, citing the mentor’s capacity to help clients achieve significant profits in forex trading. The platform’s reputation and effectiveness as a forex mentorship resource are enhanced by this award.

Top-Rated Forex Trading Course: Asia Forex Mentor was ranked as the greatest choice in a comprehensive analysis carried out by well-known forex traders and platforms due to its excellent trading system and profitable trading strategies.

These are just a few of the many awards that demonstrate how the AFM and its One Core Program consistently exceed the expectations of both new and experienced traders. Asia Forex Mentor increases the likelihood of passing the test by providing a solid foundation for those preparing to take on Trade The Pool’s challenge.

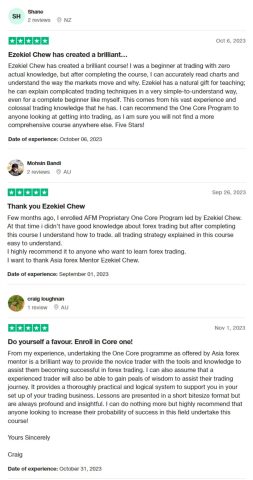

Asia Forex Mentor Members’ Testimonials

Members have given Asia Forex Mentor’s One Core Program—which was developed by Ezekiel Chew—high marks for its efficacy in teaching forex trading. Beginners emphasize how it has a transforming effect, making difficult trading concepts simple to comprehend and put into practice.

It is well known that the program may change inexperienced traders into skilled ones who can read charts and comprehend market dynamics. Even seasoned traders have gained insightful knowledge that has improved their abilities with useful tactics. All things considered, anyone wishing to learn or advance in forex trading is strongly encouraged to enroll in the One Core Program, which consistently garners excellent evaluations.

>> Also Read: Asia Forex Mentor Review By Dumb Little Man

Conclusion: Trade the Pool Review

In conclusion, Trade The Pool offers structured risk management and various account-type options, but it also has several disadvantages, including a stringent evaluation process and a brief customer support window.

Signing up with Asia Forex Mentor might be a smart move if you want to take full use of the benefits and manage them well. Ezekiel Chew’s One Core Program is an invaluable tool for traders who want to thrive in this environment since it provides the skills and information required to meet Trade The Pool’s strict requirements.

>> Also Read: Elite Trader Funding Review with Rankings 2024 By Dumb Little Man

Trade the Pool Review FAQs

Is Trade The Pool Legit?

Yes, Five Percent Online Ltd., the company that oversees Trade The Pool, is a reputable prop trading firm that was established in the United Kingdom. It provides a variety of account kinds and follows tight guidelines for risk management.

What Trading Platform Does Trade The Pool Use?

Exchange Users of The Pool’s cutting-edge trading platform can access a wide selection of equities and exchange-traded funds (ETFs) in US marketplaces. It is simple to use and browse the user interface (UI) during trading.

Can You Trade Options with Trade The Pool?

Exchange These days, exchange-traded funds (ETFs) and options for stock and equity trading are provided by the Pool. They do not offer options trading as a part of their trading portfolio.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

John V

John is a digital marketing master's student who enjoys writing articles on business, finance, health, and relationships in his free time. His diverse interests and ability to convey complex ideas in a clear, engaging manner make him a valuable contributor to these fields.