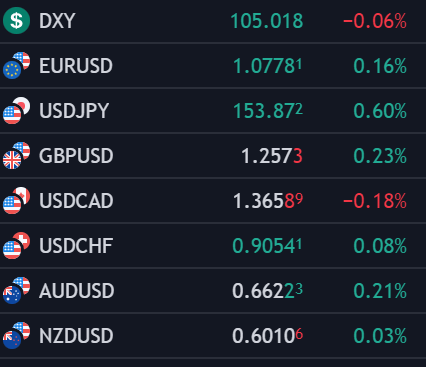

The U.S. dollar showed slight weakness on Monday, according to the DXY index, amidst a blend of mixed U.S. Treasury yields and reduced trading activity, with the UK markets closed for a bank holiday. The dollar’s performance varied, losing ground against major currencies such as the euro and the pound, yet gaining against the yen.

FX Market Insights

From the start of the month, the DXY index has fallen over 1.4% from its peak in April, despite a minor recovery from its recent low last Friday. Dollar bulls have been retreating, particularly after the Federal Reserve’s recent dovish stance and weaker than expected U.S. job figures.

The Fed’s readiness to implement easing measures amidst rekindled inflation worries, following the outcomes of the last FOMC meeting, and the subdued job market and wage growth reports from April have led to a significant drop in bond yields this May. This shift has reinvigorated speculations of potential rate cuts next year, posing challenges for the dollar’s strength.

Looking forward, the U.S. economic calendar is light on major events in the near term, which might allow the current forex trends to stabilize without significant fluctuations. However, the outlook may need reassessment in mid-May when the next U.S. CPI report is due, providing vital data on the inflation trends that are key to the Fed’s next steps.

EUR/USD Analysis – Technical Outlook

EUR/USD rose on Monday, nearing the 1.0800 mark, and approached the critical 50-day and 200-day simple moving averages. For the bears to curb the upward trajectory, it is crucial to keep the pair below these levels; otherwise, a surge towards the trendline resistance at 1.0830 and potentially up to 1.0865, a significant Fibonacci level, could occur.

Should there be a bearish reversal, the levels to watch are 1.0750 and 1.0725 for critical support. Dropping below these could shift focus to 1.0695 and then 1.0645. A test of this latter zone might stabilize the pair before another potential uptick. Conversely, breaking below could lead to a decline towards the 1.0600 level.

GBP/USD Analysis – Technical Outlook

GBP/USD also climbed on Monday, surpassing its 200-day simple moving average and advancing towards a key resistance zone between 1.0610 and 1.0630, where the 50-day SMA intersects with two significant trendlines. This area may prove tough for buyers to overcome, but a successful breakout could lead to a rally of 1.2720.

If the bears regain control and push the pair below the 200-day SMA, support lies between 1.2515 and 1.2500. GBP/USD needs to stay above this range to fend off further declines; otherwise, a drop towards 1.2430 could be on the cards. With further bearish activity, the critical psychological level of 1.2300 will be crucial to watch.