U.S. Dollar Stabilizes Amid Key Technical Setups; Forecasts for Major Currency Pairs

By Daniel M.

March 26, 2024 • Fact checked by Dumb Little Man

Market Overview

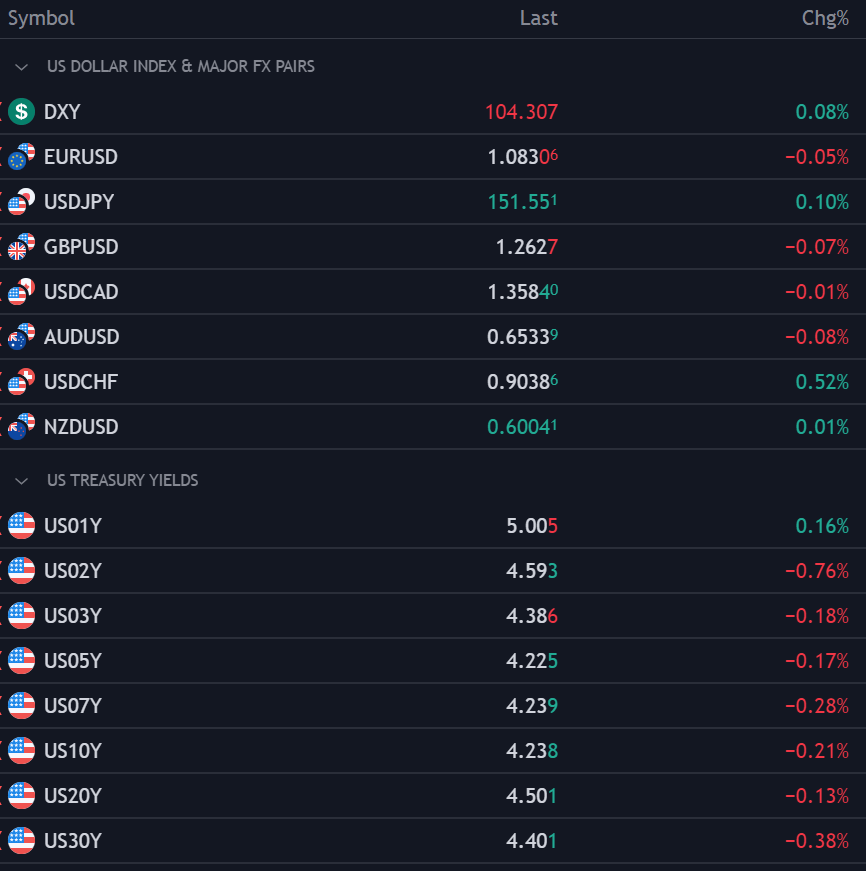

The US dollar, as measured by the DXY index, moved within a confined span on Tuesday, showing the market in a holding pattern amid uneven US Treasury yields and investor caution.

Despite the sluggish pace, the dollar managed to make small gains, with the trading world anticipating big US economic releases later this week.

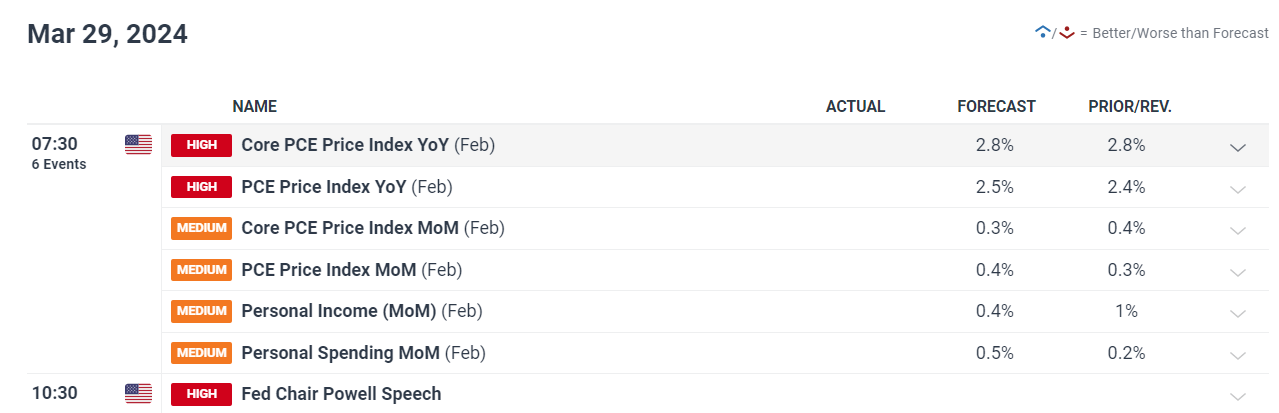

Notably, market investors are looking forward to the core PCE data, a key inflation statistic for the FOMC, as well as Fed Chair Powell‘s speech. However, the timing of these events overlaps with a bank holiday, indicating that market reaction may be delayed.

EUR/USD Analysis

The EUR/USD pair remained stagnant, unable to break through the resistance zone of 1.0835-1.0850, signaling a probable retraction to 1.0800 or even lower to 1.0725 on persistent weakening.

In contrast, a bullish scenario may see a surge towards 1.0890 and potentially 1.0925. The recent increase in German Consumer Confidence could influence the pair’s trajectory, stressing the relevance of the 1.0810 – 1.0830 support level.

USD/JPY Outlook

The USD/JPY stayed in a tight range, with the market keeping a watchful eye on the 152.00 resistance level. A breach above might lead to a bullish pursuit of 154.50 unless the Bank of Japan intervenes.

The present position at 151.50 – 152.00 has sparked discussion about possible BOJ intervention to defend the yen.

GBP/USD Forecast

GBP/USD encountered resistance after failing to capitalize on its previous rebound, pointing to potential tests of 1.2600 and 1.2510 levels on further losses.

If market sentiment swings, a break over 1.2675 might pave the way to 1.2830, making the 1.2650 – 1.2685 zone key for immediate market direction.

USD/CAD Highlights

The USD/CAD pair showed resilience, aided by the overall strength of the US dollar.

With commodity-linked currencies presenting mixed responses, notable technical levels for USD/CAD include the 50 MA at 1.3552 and the support zone of 1.3480 – 1.3500.

Economic Indicators and Market Sentiment

Recent economic reports have heightened currency traders’ caution. Durable Goods Orders outperformed expectations, while the Case-Shiller Home Price Index and CB Consumer Confidence report provided conflicting economic signals.

The expectation for stronger market catalysts remains, emphasizing the importance of impending US economic data releases in the market outlook.

Final Thoughts

As the market navigates a period of anticipation and holiday-related liquidity issues, traders must prioritize risk management and strategic positioning.

The upcoming economic measures, particularly the core PCE data and Fed Chair Powell’s speech, will undoubtedly act as watershed moments for currency markets.

Traders should stay attentive, taking into account the possibility of amplified price movements and the consequences of delayed market reactions due to the holiday weekend.

The technical setups for EUR/USD, USD/JPY, GBP/USD, and USD/CAD provide a prism through which to measure market sentiment and plan for potential changes in the trading landscape.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.