UK Unemployment Steady at 4.4% in Line with Expectations

By Daniel M.

July 18, 2024 • Fact checked by Dumb Little Man

No Major Surprises in Jobs Data

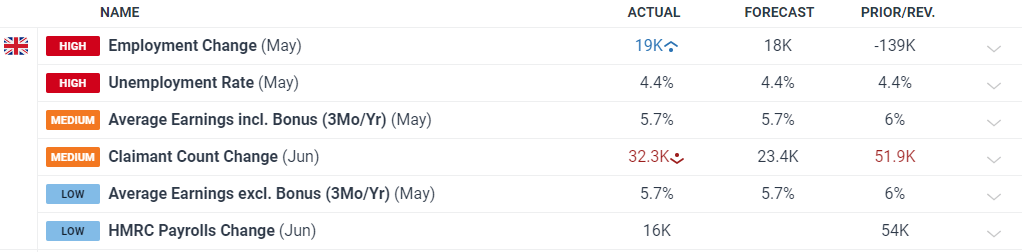

Today’s employment data provides little to influence discussions ahead of the Bank of England’s meeting on August 1st. The UK labour market has been softening for a while, with May’s claimant data being the only notable outlier, as reported last month. The number of people applying for unemployment benefits surged from 8.4k to 50.4k and was revised to 51.9k in today’s update.

June’s statistics indicate that the number of people seeking income relief remains significantly above the trend. However, the unemployment rate shows that the labour market is still healthy, though concerns about the claimant figures may rise if these elevated numbers persist.

Pound Sterling Reaction

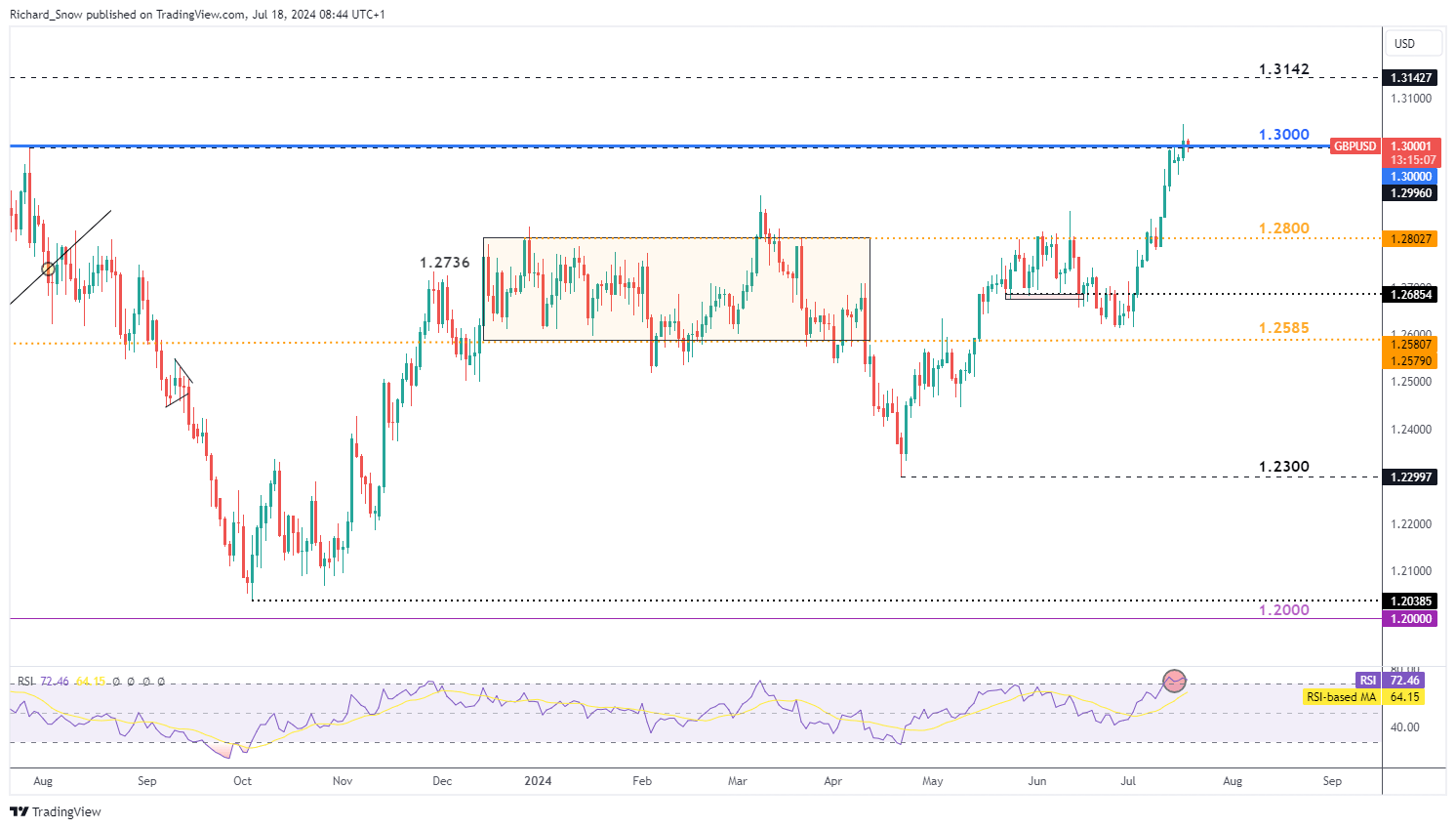

Sterling remains largely unchanged, given that the data matched expectations on most fronts.

The pound has gained from the recent increase in monthly services inflation, reducing expectations for rate cuts and supporting GBP. Additionally, better-than-expected inflation data from the US has boosted GBP/USD, pushing it to the psychological 1.3000 level.

Despite the bullish outlook for GBP/USD, initiating long positions from this point does not offer a favorable risk-to-reward ratio. A pullback could present a better entry opportunity in line with the trend, especially now that the pair is trading in overbought territory around the 1.3000 mark.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.