Geopolitical Easing Focuses Market on Fundamentals

Traders might experience some relief as Iran has decided against further retaliation against Israel, hinting at possible de-escalation in the Middle East. This development shifts the focus back to the core market drivers.

Economic Data to Watch

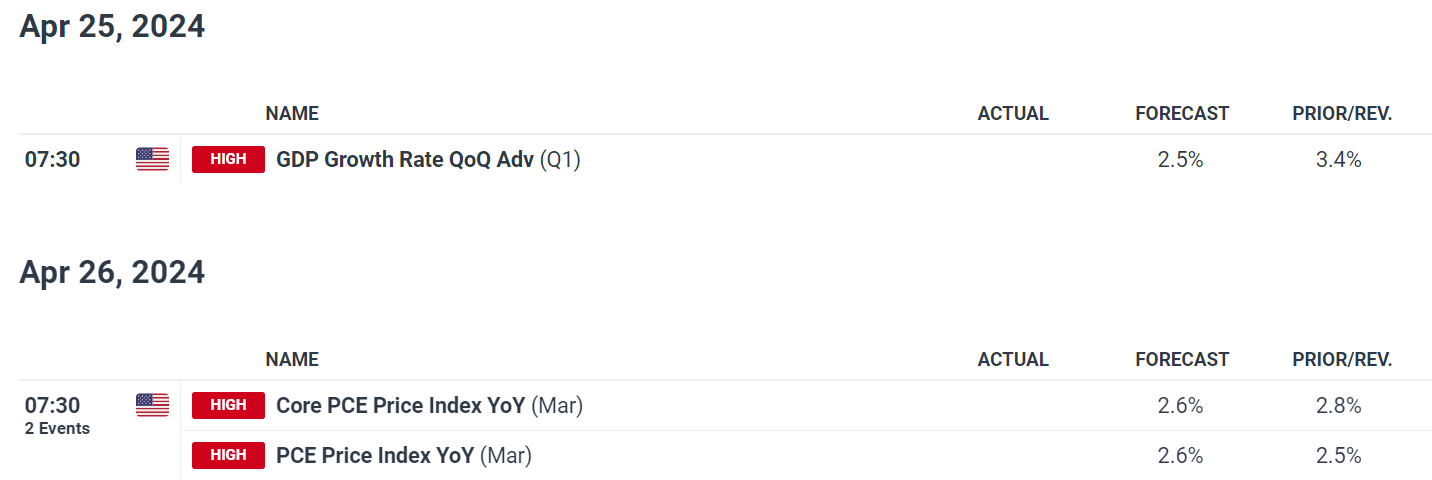

This week, key economic indicators will capture the market’s attention. The US GDP for the first quarter and the core PCE for March are especially critical, serving as significant indicators of inflation trends for the Federal Reserve. Considering the recent strong performance in retail sales and price indices, these reports might surpass initial forecasts.

If these indicators come in higher than expected, it could suggest that the US economy is robust and inflation remains entrenched. Such outcomes might lead investors to expect prolonged higher interest rates by the Fed, potentially boosting US yields and the dollar.

Tech Giants Report Earnings

The earnings season continues with major tech firms like Tesla, Meta, Alphabet, Amazon, and Microsoft reporting. These results will provide valuable insights into the corporate sector’s health. Positive earnings could propel the markets, whereas underwhelming results might highlight upcoming economic hurdles

Central Bank Focus: Bank of Japan

The spotlight is on the Bank of Japan as it makes its latest policy decision. Market participants will scrutinize any hints regarding future rate hikes. A delay in rate increases could put additional pressure on the Japanese yen. However, due to the yen’s recent weakness, the BoJ may lean towards a more hawkish policy to support the currency.

Key Market Insights

The week ahead is packed with potential market-moving events, including geopolitical developments, critical economic data, earnings updates, and central bank decisions. For traders, staying updated on these factors is essential for effective risk management and capitalizing on opportunities.