Crude Oil Price Fluctuations

US crude oil prices surrendered their initial gains in Europe on Wednesday, although they remained within the market’s recent trading range.

Factors Influencing Early Support

The energy sector received an initial boost following a report that showed a significant reduction in US crude inventories. The American Petroleum Institute revealed a decline of 3.01 million barrels for the week ending May 10, significantly exceeding expectations and contrasting sharply with the previous week’s increase.

Persistent Demand Worries

Despite these inventory draws, concerns about the sustainability of demand persist. The International Energy Agency reduced its 2024 oil-demand projection on Wednesday, foreseeing an increase of only 1.1 million barrels per day, down 140,000 barrels from earlier estimates. This revision reflects broader apprehensions about a potential oversupply, despite ongoing production cuts by OPEC and its allies.

Economic Indicators and Impact on Rates

The uncertainty around the timing of interest rate reductions in the US and other advanced economies remains high. Inflation trends are aligning with policy objectives, but fluctuating US producer prices indicate potential challenges ahead. Central banks are cautious about easing rates prematurely, aiming to ensure lasting impacts on inflation.

Geopolitical Tensions and Supply Risks

Geopolitical conflicts and natural disasters continue to underpin oil prices. Ongoing unrest in Ukraine and Gaza, along with a significant wildfire near Fort McMurray—an essential site for Canadian oil sands production—raise concerns about supply disruptions.

Upcoming Market Data

Further insights are expected with the upcoming release of inventory data by the Energy Information Administration on Wednesday.

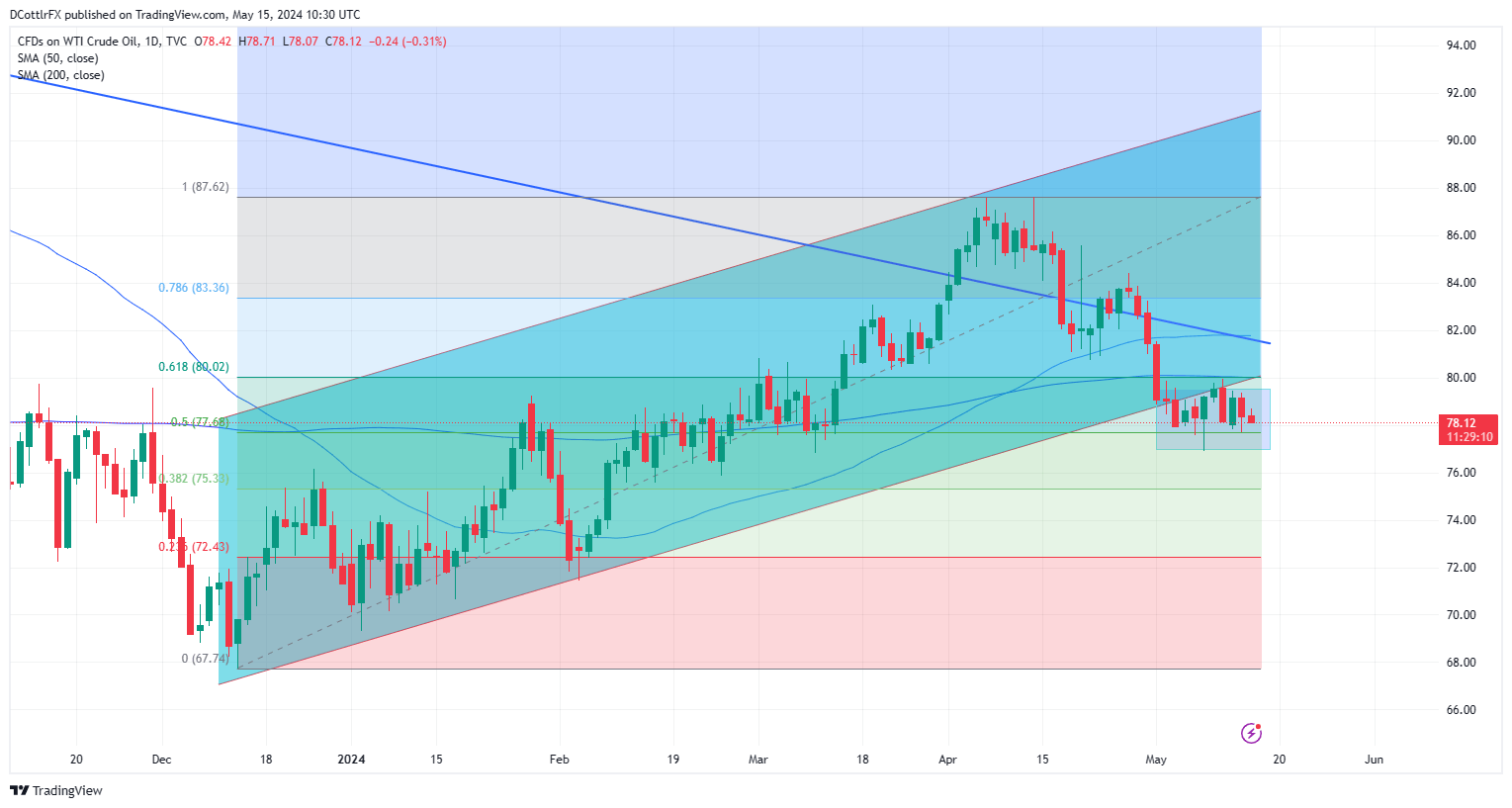

The struggle to maintain support above the $78.00 level continues, with the market oscillating between $79.44 and $76.86. Key technical indicators suggest a consolidating market, with potential resistance approaching from a downtrend line that started in mid-2022. The ability of bulls to sustain prices above the 50- and 200-day moving averages could be crucial in determining the market’s direction in the near term. Investors remain watchful, anticipating clearer signals by the week’s end.