US Dollar Forecast: Markets Eye NFP After Manufacturing Scare

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

Concerning Forward-Looking Data Impacting Next Week’s Market Open?

The dollar experienced a dip at week’s end, following slightly concerning US manufacturing data. This data highlighted a continued contraction in the manufacturing sector for the 16th consecutive month.

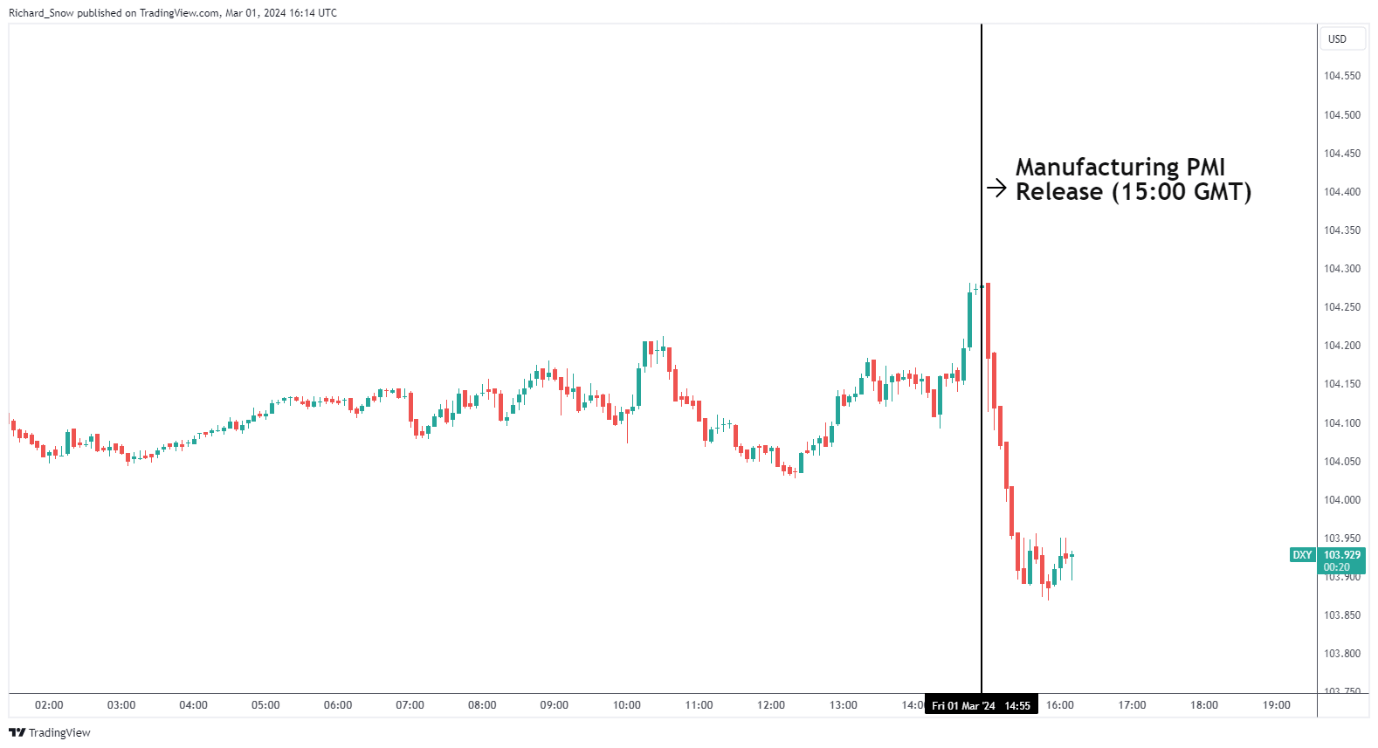

Key areas of concern highlighted were the sub-indices for ‘employment’, ‘production’, and the ‘new orders’ metric, all showing declines from January. Despite being considered ‘soft data’, the market’s reaction underscored its significance. The chart below shows the dollar basket’s (DXY) immediate response.

US Dollar Benchmark (DXY) 5-Minute Chart

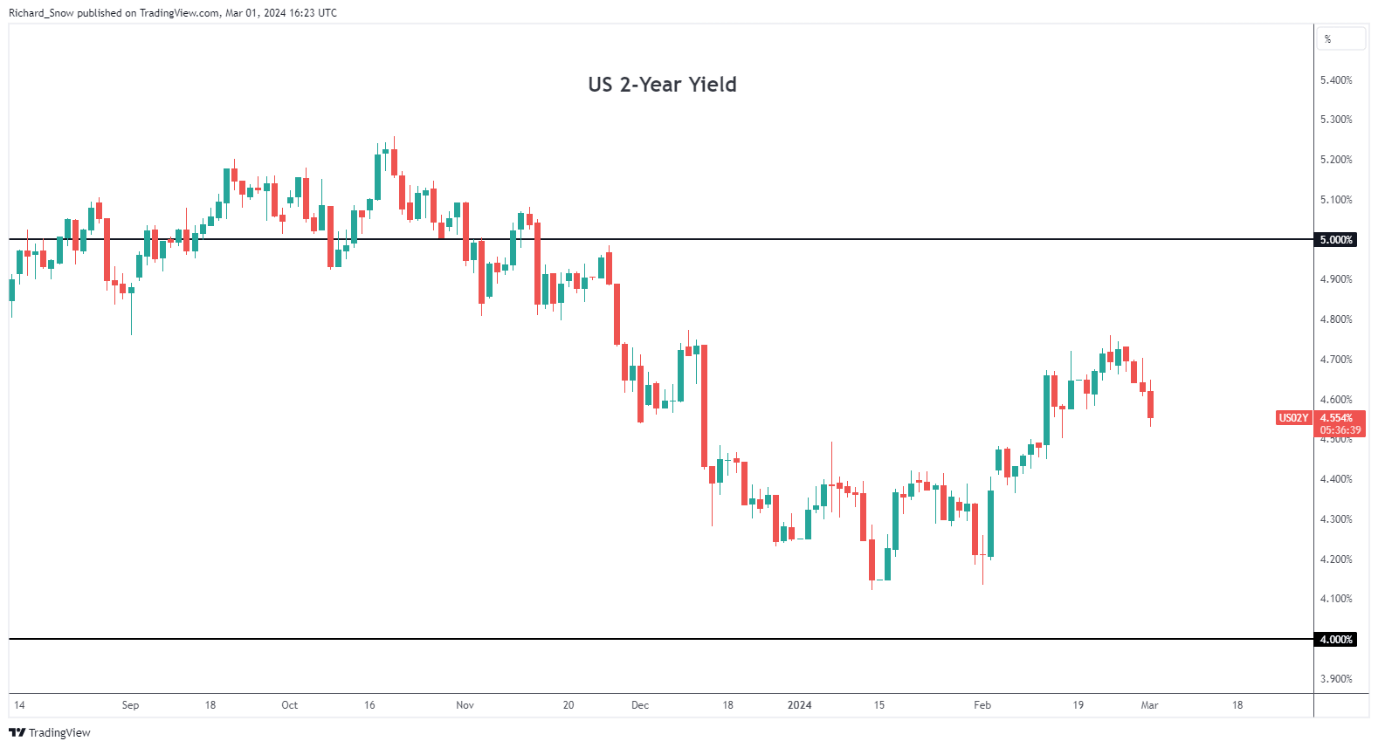

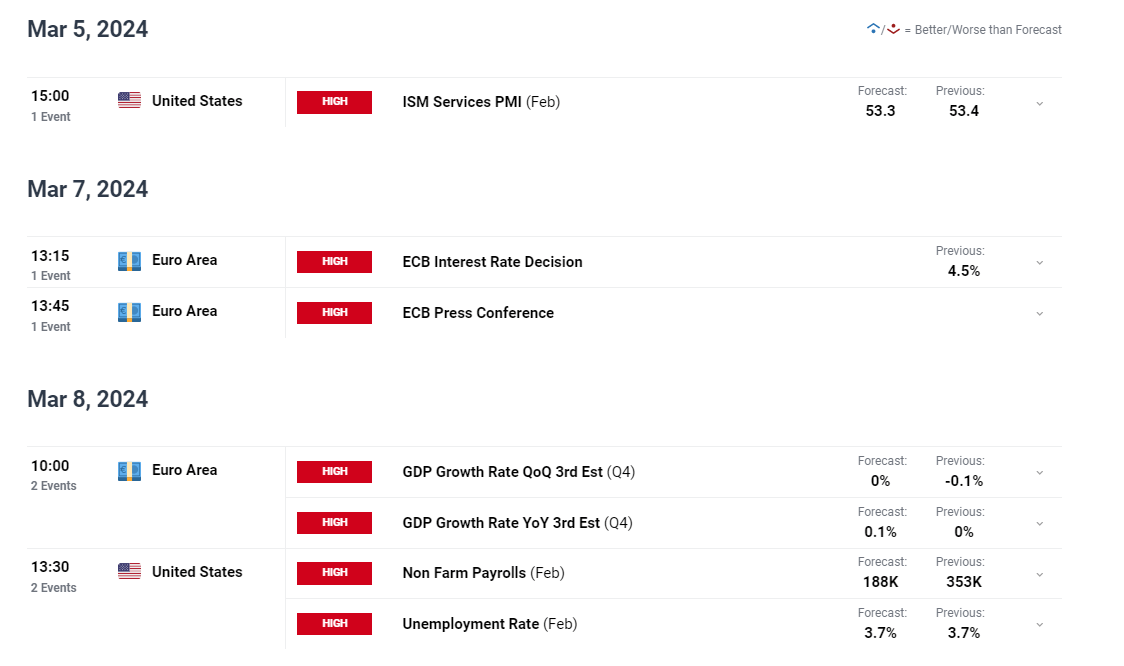

The upcoming US services PMI is now under the spotlight, given the service sector’s large contribution to US GDP. This focus follows a downward trend in US Treasury yields, hinting at potential rate cuts anticipated in mid-2025.

US 2-Year Treasury Yield Daily Chart

US Dollar Gains Support Amid Fed’s Rate Cut Strategy

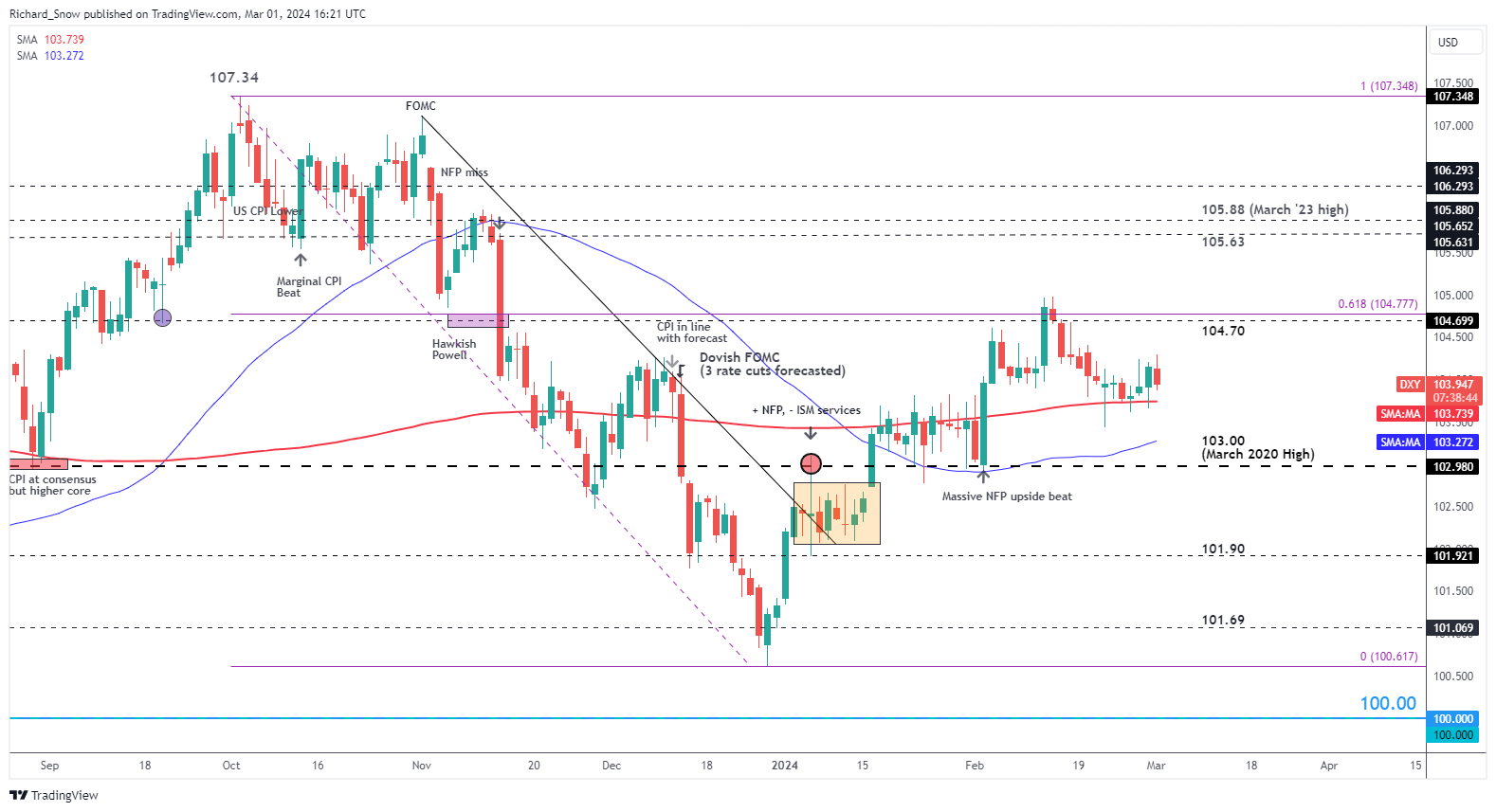

The Fed’s foresight on rate cuts seems validated, aligning with market predictions from the Fed’s December summary. The anticipation has shifted to three rate cuts in 2025, causing the dollar to stabilize early in the year, despite a dip since February.

The 200-day simple moving average (SMA) has provided some support against the bearish trend. Yet, the market has struggled to maintain directional moves, indicating a preference for range trading strategies as we approach the first rate cut.

Next week’s ISM services PMI data could pivot the dollar’s direction, with resistance and support levels closely watched by USD bulls.

US Dollar Basket (DXY) Daily Chart

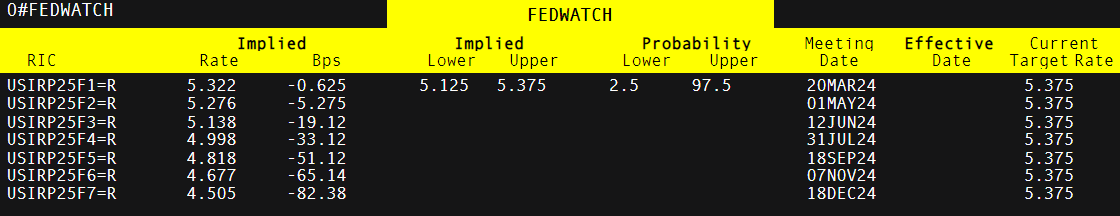

Markets are now betting on 75 basis points worth of cuts this year, with March’s meeting unlikely to set a date for the first cut.

Implied Rate Cuts from the Fed Funds Futures Market

Upcoming US Dollar Risks: Services PMI, NFP

The ISM services PMI and NFP data in the coming week will be pivotal, especially after the manufacturing sector’s further contraction. Despite manufacturing’s smaller economy share, a robust services sector could mitigate concerns.

The ECB’s meeting will also be critical, influencing the dollar index through its significant impact on the EUR/USD pair.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.