Inflation Data Surprises, Dollar Strengthens

The US dollar rallied significantly, reaching its highest level against the Japanese yen since 1990, fueled by surprise inflation data.

The March Consumer Price Index (CPI) showed a prolonged inflationary trend in the United States, propelling the USD/JPY pair to fresh 2025 highs. This development casts doubt on the Federal Reserve’s planned rate cut in June.

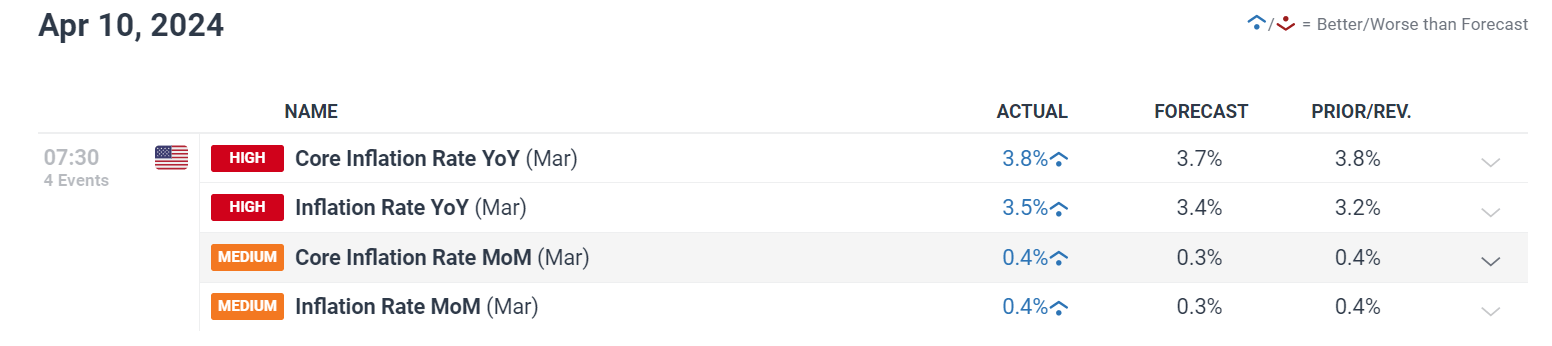

Headline CPI grew 3.5% year on year, exceeding estimates and the prior month’s 3.2%. The core CPI, which excludes volatile goods such as food and energy, also topped expectations at 3.8%, implying a rebound in pricing pressures.

Market Reaction and Federal Reserve’s Stance

The market responded quickly, with US Treasury yields rising across the board. This indicates increased speculation that the Federal Reserve will keep monetary policy tighter for longer than expected.

Additionally, the timetable and extent of future rate cuts were delayed as traders changed their FOMC expectations. However, futures contracts have relaxed by less than 40 basis points for a year, with the first decline coming in September.

The table below shows meeting possibilities.

As a result, futures contracts expect less easing this year, with the first-rate cut possible in September.

Fed Chairman Powell had previously played down inflation concerns. However, the recent spate of higher-than-expected CPI statistics may result in a more hawkish Federal Reserve shortly, perhaps strengthening the dollar even more.

USD/JPY Technical Outlook

The USD/JPY pair broke past the 152.00 barrier level, indicating more advances. However, the prospect of Japanese intervention to support the yen lurks, particularly as the currency approaches historic lows.

Technical analysis implies that if the yen’s drop is not addressed, speculators may target 155.70 next.

In contrast, a decline below 152.00 might find support at 150.90, with a further drop potentially leading to a retest of the 50-day simple moving average at 150.00.

The dollar’s surge was felt across all major currencies, with notable swings in the dollar index and versus the euro.

The market is looking for any signals of intervention from Japanese officials, which have engaged in the currency market multiple times in recent years to strengthen the yen.

With US interest rates rising and Japan’s holding around zero, the yen has been consistently under pressure, prompting investors to seek better returns in the dollar.

Given the yen’s fast decline, speculation about a possible Japanese intervention has grown.

Final Thoughts

The surprise surge in US inflation has had a big influence on currency markets, pushing the US dollar to a 34-year high against the yen. While this illustrates widespread dollar strength, it also raises concerns about sustained inflationary pressures in the US.

Market investors will closely watch the Federal Reserve’s reaction to these events, as well as the possibility of Japanese intervention in support of the yen.

As traders negotiate this volatile landscape, the balance between US monetary policy and Japanese economic policies will be critical in predicting future currency moves.