US Dollar Index Drops as Inflation Data Falls Short of Expectations

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

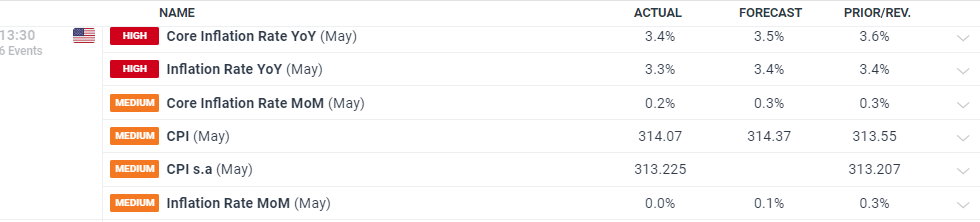

US Bureau of Labor Statistics – US CPI Report (May)

The latest US inflation report revealed a more significant easing in price pressures than anticipated. All headline figures were below expectations and last month’s numbers. The unexpected drop in core CPI y/y from 3.6% to 3.4% surprised the market, causing the USD to decline and boosting risk markets.

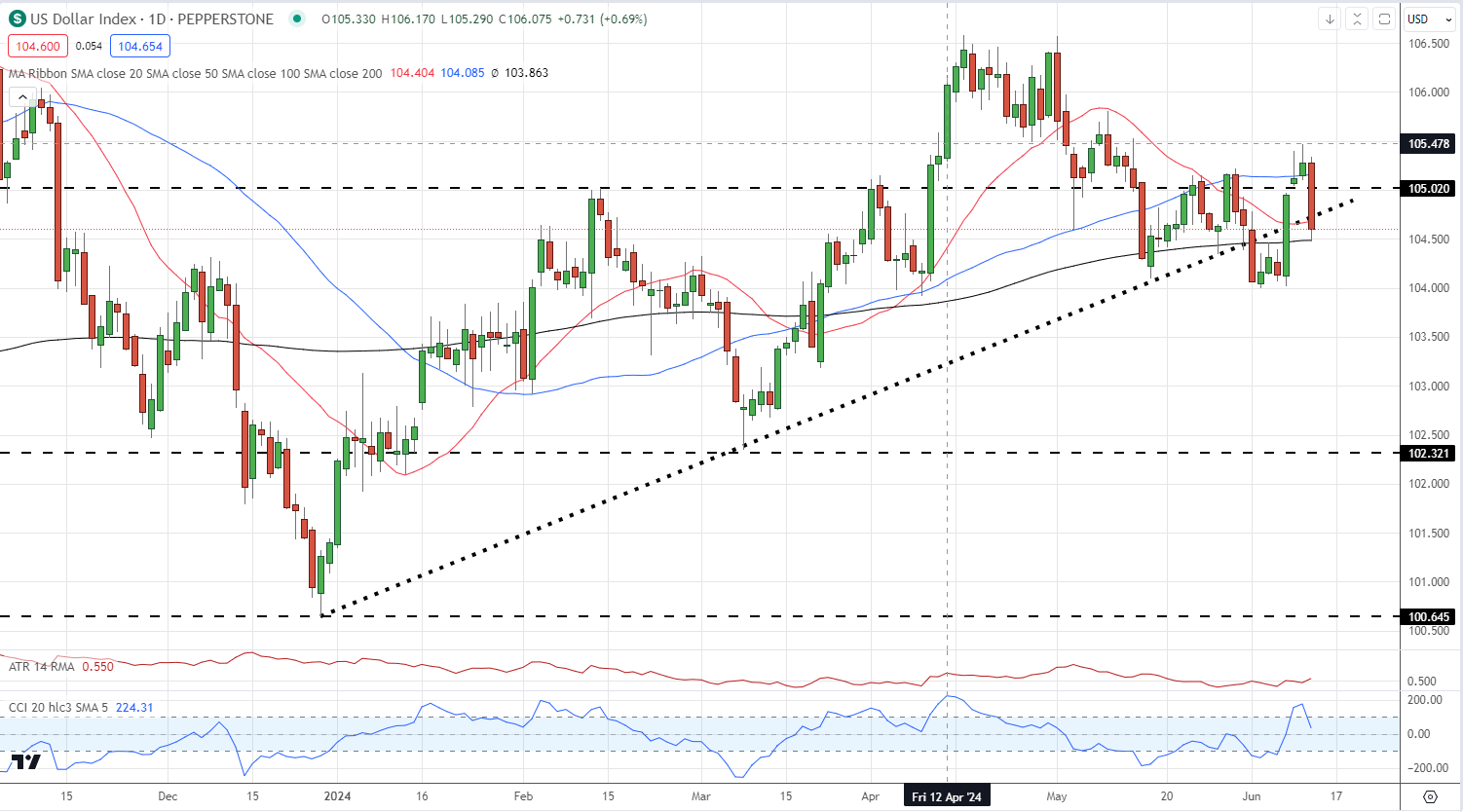

Following the release, the US dollar index fell by approximately 0.75 points before stabilizing near the 200-day simple moving average. This significant drop reflects market reactions to the unexpected inflation data, indicating reduced confidence in the USD. Traders and investors quickly adjusted their positions, leading to heightened volatility.

Eventually, the 200-day simple moving average provided a technical support level, helping the index stabilize and prevent further decline.

US Dollar Monitors CPI Data and FOMC Policy Release, Dot Plot as Key Indicator

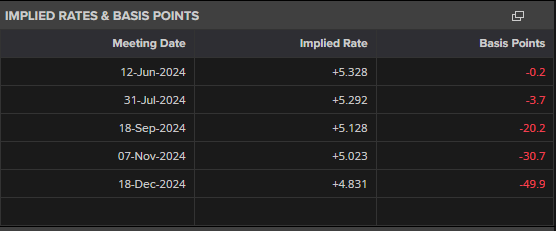

Later today (19:00 UK), the Federal Reserve will announce its latest monetary policy decision and quarterly Summary of Economic Projections. While the central bank is expected to maintain current policy settings, today’s inflation report may influence their future interest rate decisions. The new dot plot will be crucial to watch.

Before the CPI release, the market predicted a total of 39 basis points of easing this year; this has now been adjusted to just under 50 basis points. The September meeting is now considered for the first-rate cut.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.