US Dollar Market Analysis: Insights on EUR/USD and GBP/USD Recovery, USD/JPY Stability

By Daniel M.

March 26, 2024 • Fact checked by Dumb Little Man

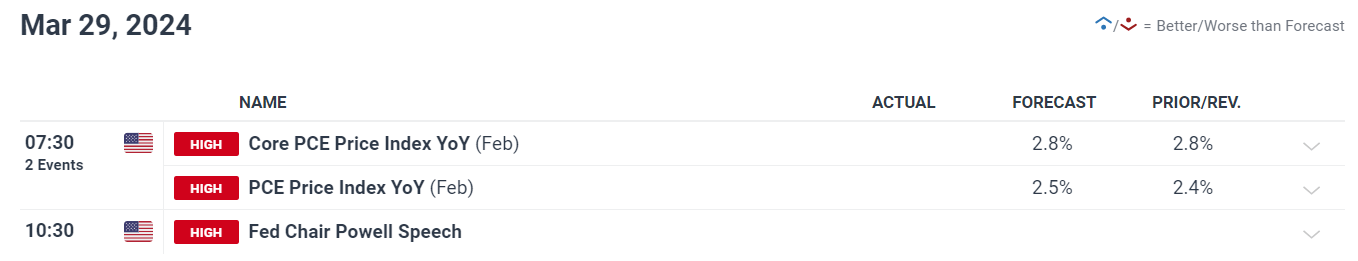

The US dollar experienced a minor decline on Monday, though the drop was minimal, likely restrained by a rise in U.S. Treasury yields. Investors took profits following the dollar’s robust performance the previous week. Additionally, many chose not to take significant positions ahead of anticipated major events such as the core PCE data release and a speech by Powell on Friday.

Transitioning from fundamental to technical analysis, this piece delves into the sentiment and price movements for three key dollar currency pairs: EUR/USD, GBP/USD, and USD/JPY. We will highlight crucial support and resistance levels crucial for risk management in position building.

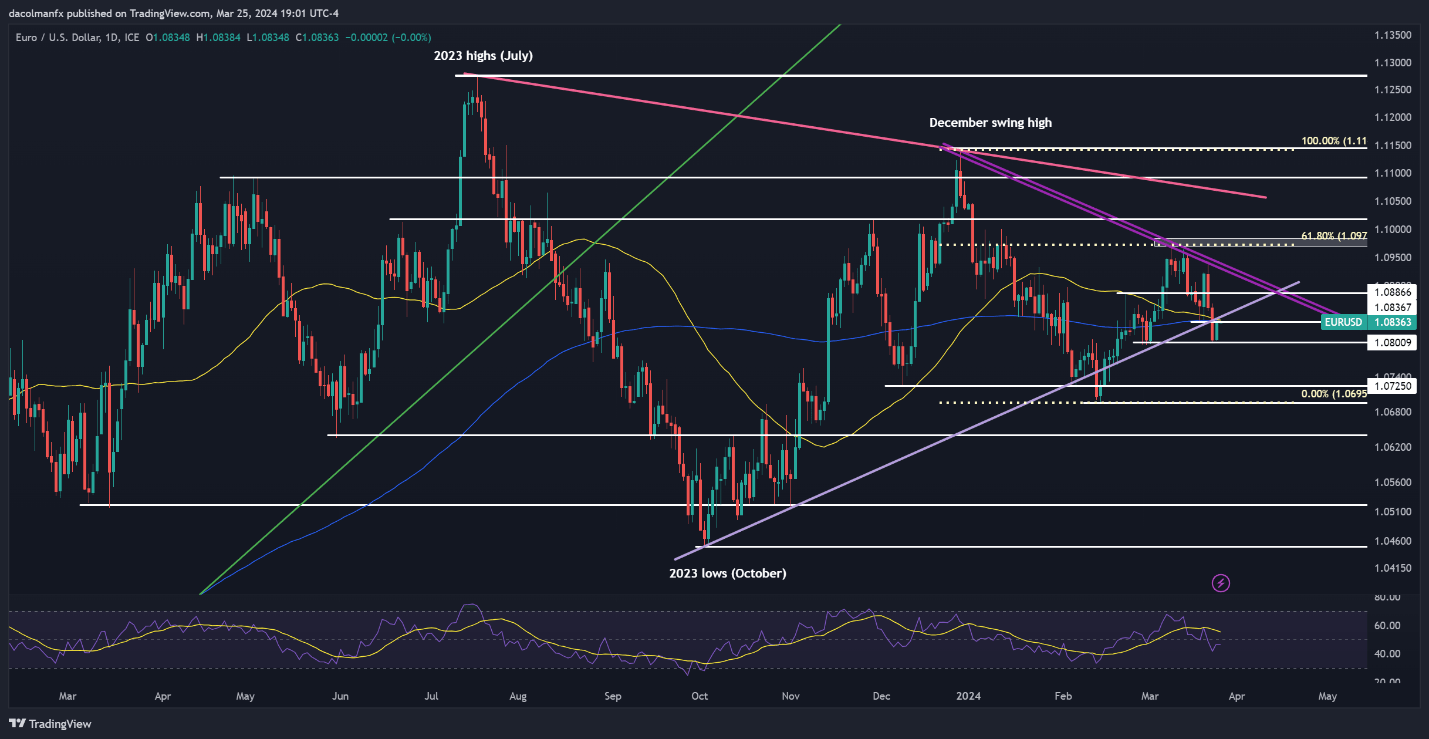

EUR/USD Technical Analysis

EUR/USD saw an uptick on Monday, bouncing back from support near the 1.0800 mark, with the price nearing a resistance confluence at 1.0835-1.0850. Bulls must steadfastly defend this zone to avoid a potential push towards 1.0890 and then 1.0925.

Should sellers take over, causing a downturn, support is again found at 1.0800. Holding this level is vital to avert a drop in the euro, with a potential decline extending towards 1.0725 if breached.

For those keen on predicting the pound’s next significant movement, access our quarterly forecast for detailed market insights. Secure your free guide today for comprehensive market trend analysis!

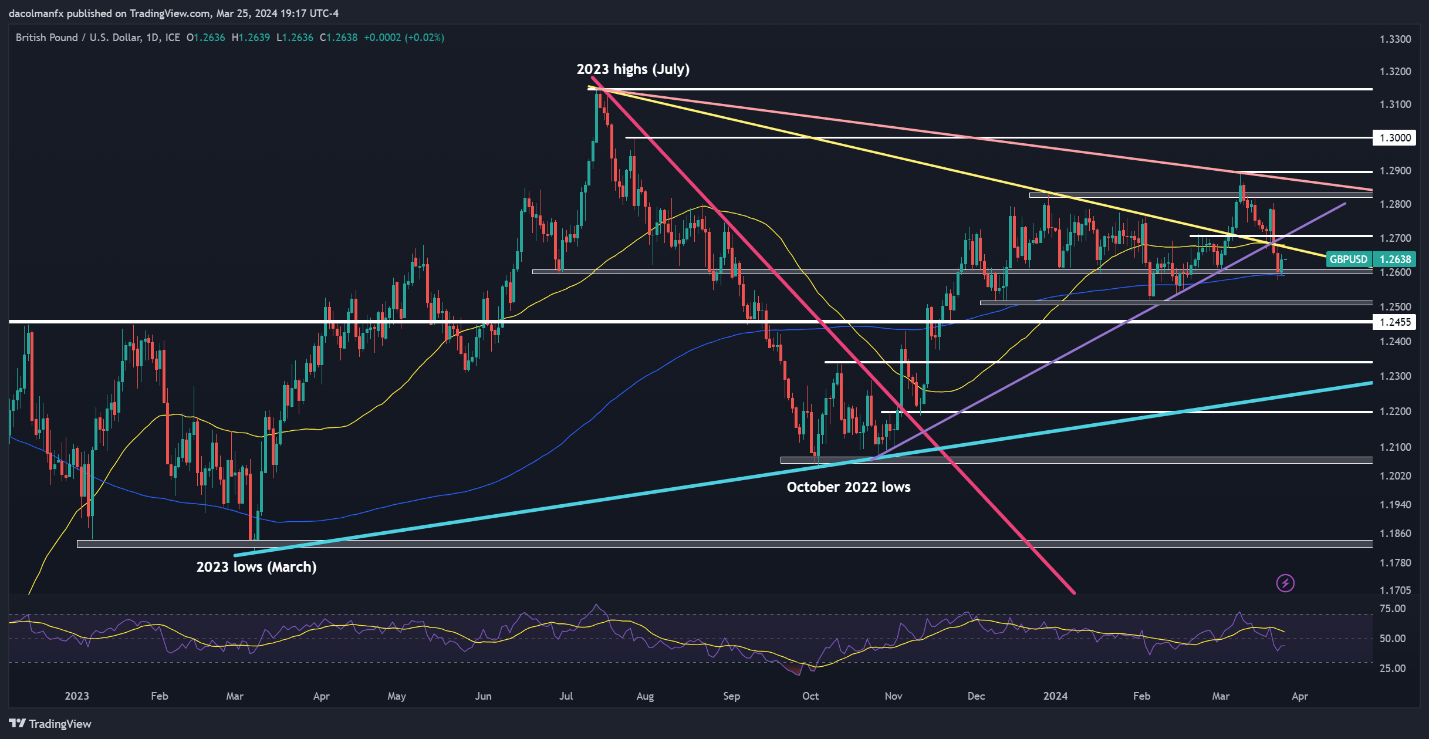

GBP/USD Technical Analysis

GBP/USD stabilized on Monday after a sharp decline the previous week, with the pair recovering ground after hitting support at the 200-day SMA near 1.2600. If the rebound strengthens, it faces resistance at 1.2675, 1.2700, and finally 1.2830.

Conversely, if sellers regain the upper hand, pushing the rate down, the 1.2600 level serves as crucial support. Falling below this could quickly lead to further declines, targeting 1.2510.

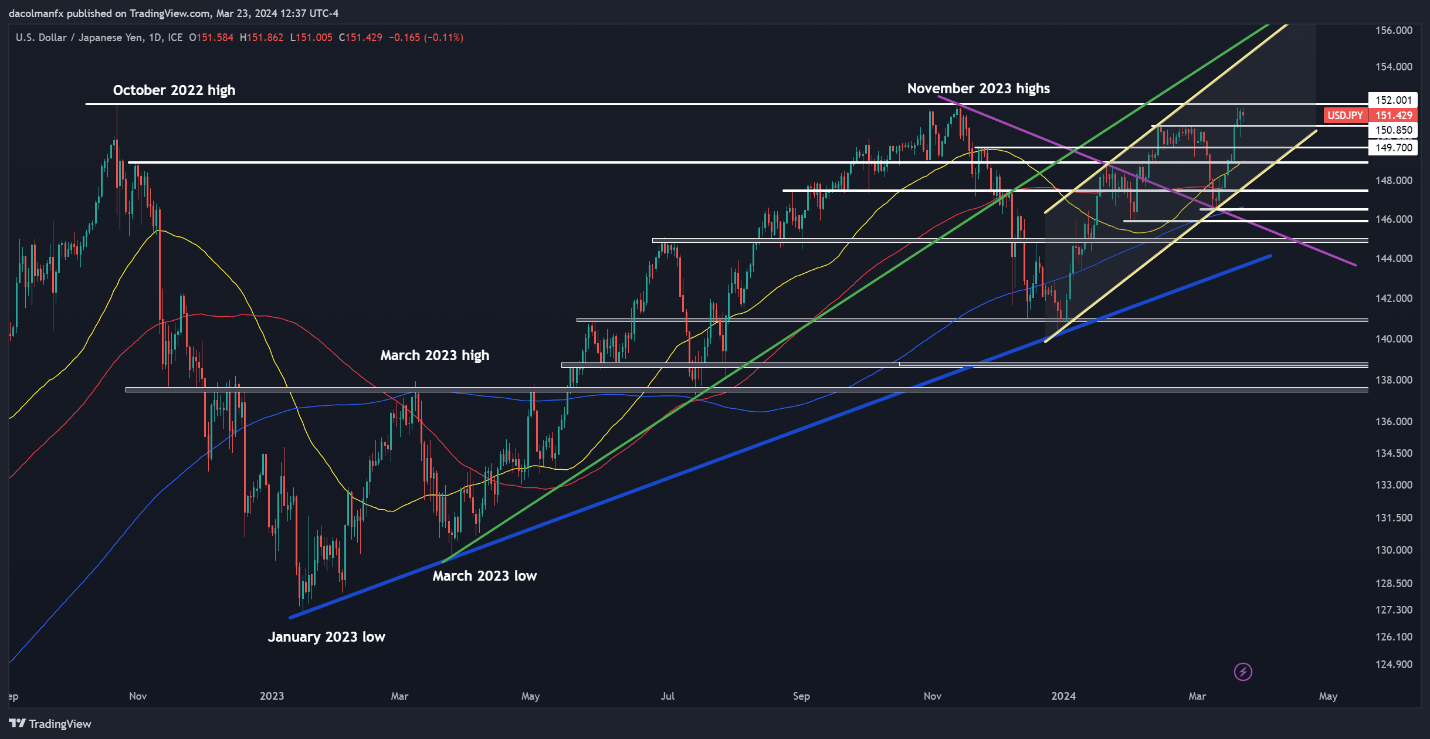

USD/JPY Technical Analysis

USD/JPY remained directionless on Monday, stabilizing just below the peak of the previous year at 152.00. Surpassing this level might trigger interventions by Japanese authorities to support the yen, potentially capping the rally. In the absence of intervention, moving beyond 152.00 could lead to a climb towards 154.40.

If the momentum shifts to bears, leading to a downturn, support is found at 150.90 and 149.75. A retreat to these levels could precede stability, whereas a further drop might head towards the 50-day simple moving average at 148.90.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.