US Dollar Stabilizes After Strong ISM Services Data

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

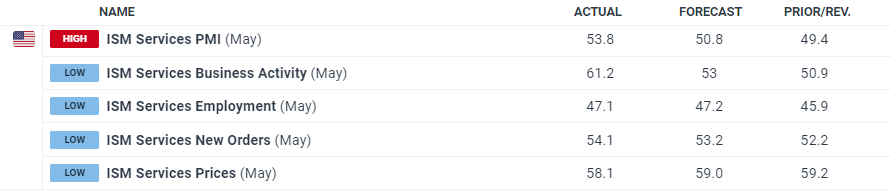

The latest ISM services report indicates Robust US business activity, with the headline index surpassing both forecasts and the previous month’s reading.

Tuesday, June 4th

Wednesday, June 5th

According to Anthony Nieves, Chair of the Institute for Supply Management (ISM), “The increase in the composite index in May is a result of notably higher business activity, faster new orders growth, slower supplier deliveries, despite the continued contraction in employment. Survey respondents indicated that overall business is increasing, with growth rates continuing to vary by company and industry.”

Nieves added, “Employment challenges remain, primarily due to difficulties in backfilling positions and controlling labor expenses. The majority of respondents indicate that inflation and current interest rates are hindering improvements in business conditions.”

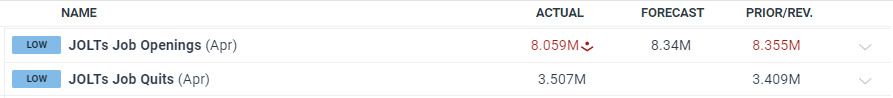

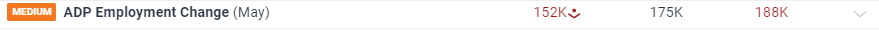

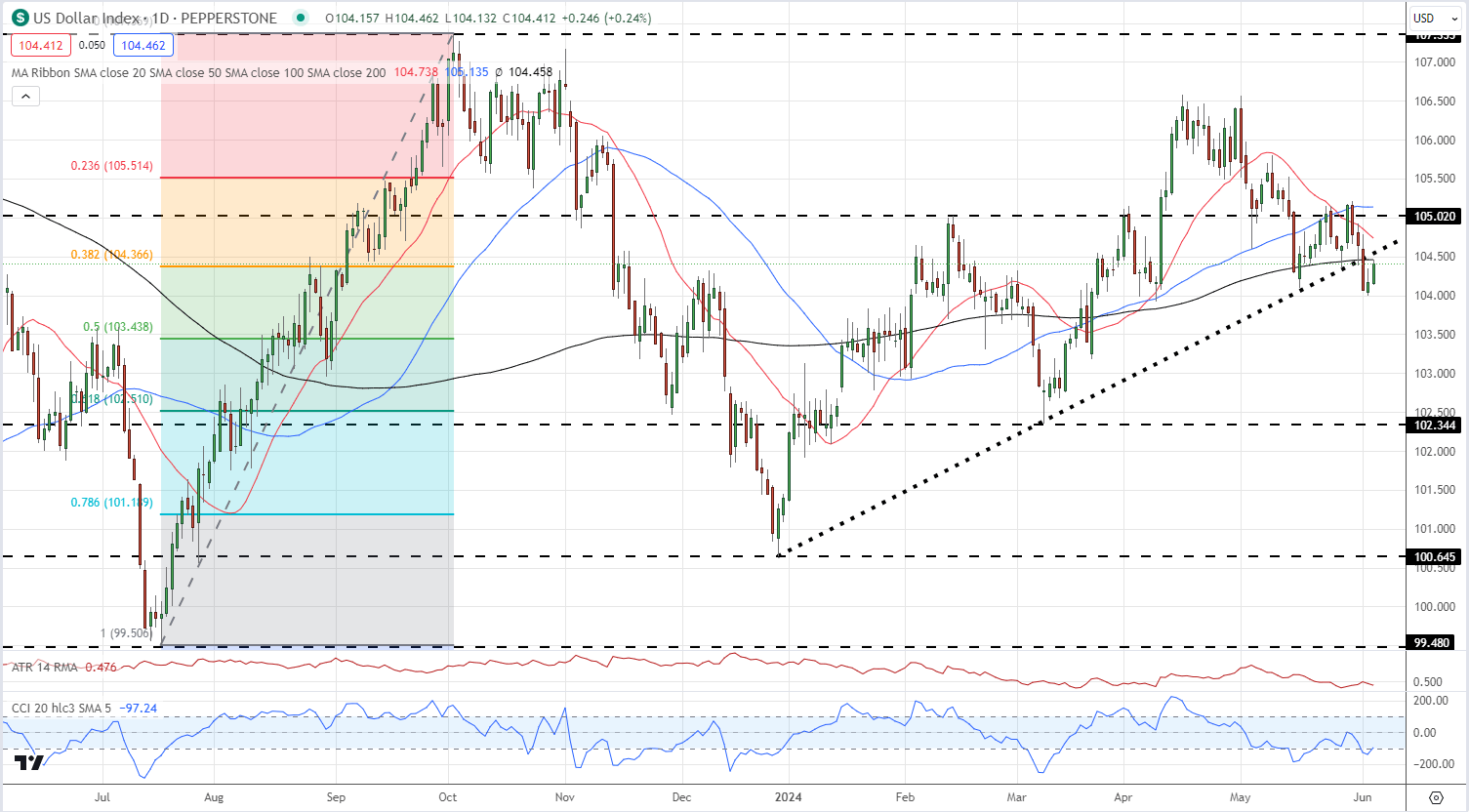

The US dollar gained slightly after the ISM data, slowing this week’s losses. The US dollar index has been declining since hitting a two-week high last Thursday, driven by slightly better-than-expected US inflation, last Friday’s weak Chicago PMI (35.4 vs. 41 forecast), and this week’s worse-than-expected JOLTs and ADP jobs reports.

The recent sell-off has pushed the US dollar index below all three simple moving averages and broken a multi-month series of higher lows. The 200-day SMA, the recent uptrend, and the 38.2% Fibonacci retracement are now acting as near-term resistance. Friday’s US Jobs Report (NFP) has become the main focus, and any further signs of weakness in the US job market could drive the dollar down further.

US dollar traders should also monitor tomorrow’s ECB policy decision, where President Lagarde is expected to announce a 25 basis point interest rate cut. If Ms. Lagarde hints at a second cut at the July meeting, the Euro will weaken, boosting the US dollar index. The Euro makes up around 58% of the dollar index.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.