US Growth Hits 2.8% in Q2, Dollar Steady

By Daniel M.

July 25, 2024 • Fact checked by Dumb Little Man

The US economy grew by 2.8% in Q2, beating market expectations of 2%, according to the latest BEA data. This growth represents an acceleration from the 1.4% increase in the first quarter.

The rise in real GDP for Q2 is primarily due to an uptick in private inventory investment and increased consumer spending. However, a downturn in residential fixed investment partially offset these gains. The BEA notes that this advance reading is based on incomplete or potentially revisable data, with a second estimate due on August 29th.

Durable Goods Orders Fall Significantly

Durable goods orders dropped by 6.6%, contrary to the forecast of a 0.3% increase, driven mainly by a significant decline in transportation equipment. Excluding transportation, new orders saw a 0.5% rise.

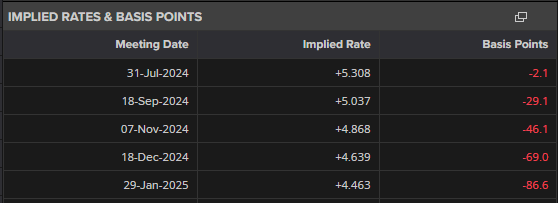

The stronger-than-expected GDP figures reduced US rate cut expectations by two to three basis points. Nevertheless, markets still anticipate a 25 basis point rate cut at the September 18 meeting, with additional quarter-point cuts expected on November 7 and December 18.

US Dollar Remains Stable

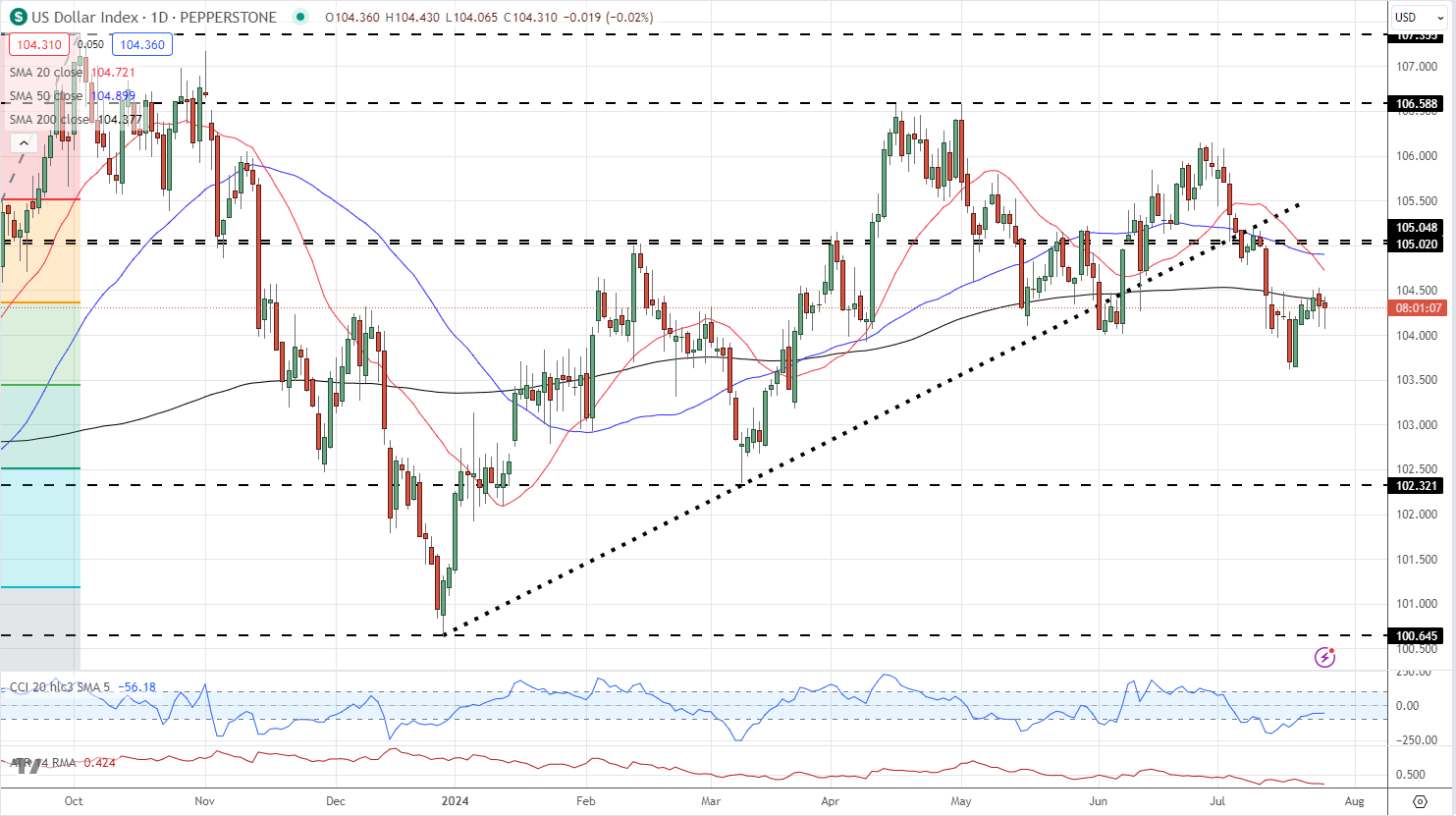

The US dollar index saw a slight increase but remains calm ahead of Friday’s Core PCE data. The DXY is fluctuating around the 200-day SMA and is expected to maintain this range until 13:30 UK time tomorrow.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.