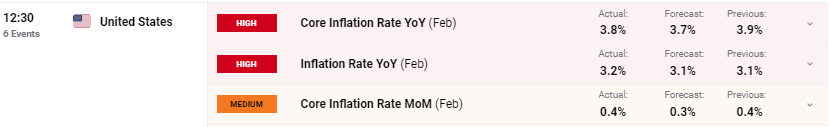

In a recent update that has caught the attention of traders, the US inflation report for February indicated an unexpected uptick in headline inflation, surpassing economists’ predictions, while core inflation saw a slight decline. Both year-on-year measurements exceeded forecasts by 0.1%, signaling a nuanced landscape for market participants.

The Bureau of Labor Statistics highlighted key contributors to this trend, noting significant increases in the shelter and gasoline indexes. These categories alone were responsible for over sixty percent of the month’s overall rise in the all-items index. Specifically, the energy index surged by 2.3 percent, reflecting rises across all its components. meanwhile, the food index was constant from the previous month, with the food at home index being stable and the food away from home index increasing by 0.1 percent.

US Dollar Index Daily Chart

Following the announcement of the inflation figures, the US dollar witnessed a small increase, with the US dollar index rising back above 103.00. Despite this shift, market expectations for the Federal Reserve’s future interest rate adjustments remained constant. The likelihood of a rate drop by June remains above 80%, indicating that traders are balancing inflation data with broader economic policy expectations.

Gold Daily Price Chart

On the commodities front, gold has seen a modest pullback from its recent run, although the decline has been controlled. Gold’s present support levels are at $2,050 per ounce, with a potential slide to $2,120 per ounce if downward pressure continues. This reaction in the gold market demonstrates the complicated interplay between inflation data, currency strength, and traders’ expectations for interest rates.

Final Thoughts

For investors and traders who keep a close eye on economic indicators, the latest inflation report highlights the persistent challenges of balancing growth, price stability, and monetary policy. As the market digests these numbers, traders should keep an eye on upcoming economic releases and central bank communications for more information on prospective changes in the US economic picture.