Rising Jobless Rate Signals Economic Strain

Non-farm payroll data for July fell short of expectations, revealing a notable slowdown in hiring for June. The unemployment rate surged to 4.3%, surpassing the anticipated 4.2% and exceeding 4% for the second consecutive month. This unexpected rise added pressure on the US dollar, which saw a decline following the news.

Historically, the US job market has been praised for its resilience. However, the latter half of the year is showing signs of stress as tighter monetary policies impact the broader economy.

Early Indicators Pointed to a Decline

Before the July NFP data, several indicators suggested a downturn. The employment sub-index of the ISM manufacturing survey plummeted from 49.3 to 43.4. Additionally, the overall index dropped to 46.8 from 48.5, falling below 50 for the 20th time in the past 21 months. Despite this, the upcoming ISM services data could have a more significant impact due to the sector’s dominance in the US economy.

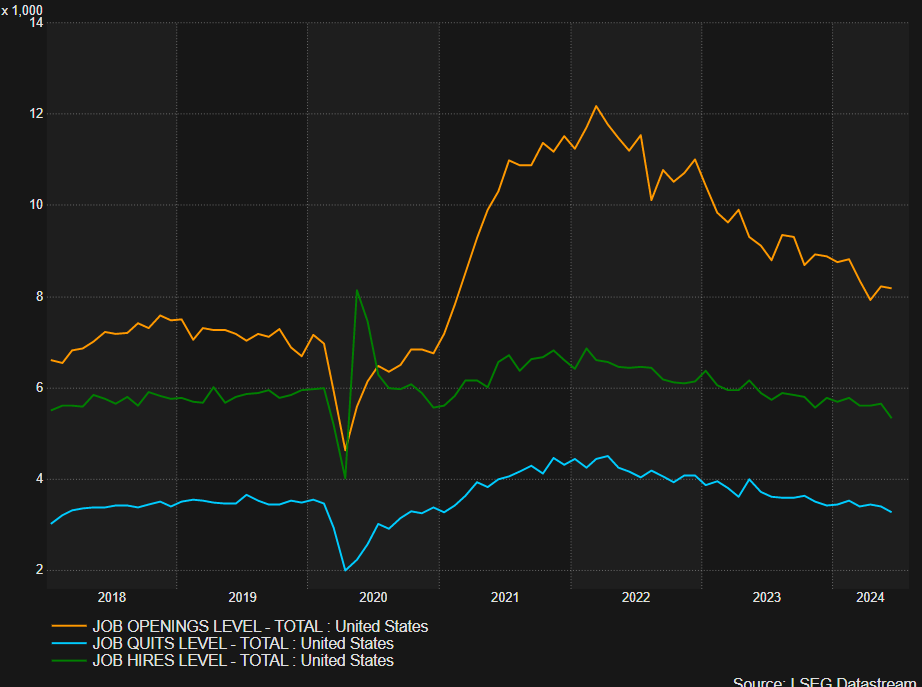

Long-term signs of a weakening labor market have been evident, with decreases in job openings, hires, and voluntary quits.

Implications for the Federal Reserve

In the week of the FOMC meeting, the disappointing jobs report aligns with the Fed’s increased focus on employment. This has led to speculation that the Fed might start the upcoming rate cut cycle with a 50-basis point cut. Market odds of such a cut stand at 80%, although this could change as the Fed aims to avoid market disruption.

Current expectations include four 25-basis point cuts or a combination of one 50 bps cut and two 25 bps cuts by year-end. This outlook differs from the Fed’s June dot plot, which indicated a single rate cut.

Dollar and Treasury Yields Under Pressure

The US dollar weakened as inflation showed signs of easing and rate cut expectations increased. The dollar’s decline accelerated post-data release, with potential short-term support at 103.00.

US Treasury yields also fell, with the 10-year yield comfortably below 4% and the 2-year yield just below the same level.

Gold Reacts to Economic Uncertainty

Gold prices surged immediately after the data release but returned to pre-announcement levels. Gold, which typically moves inversely to US yields, is poised for growth amid falling treasury yields and heightened geopolitical tensions following Israel’s targeted attacks in Lebanon and Iran.