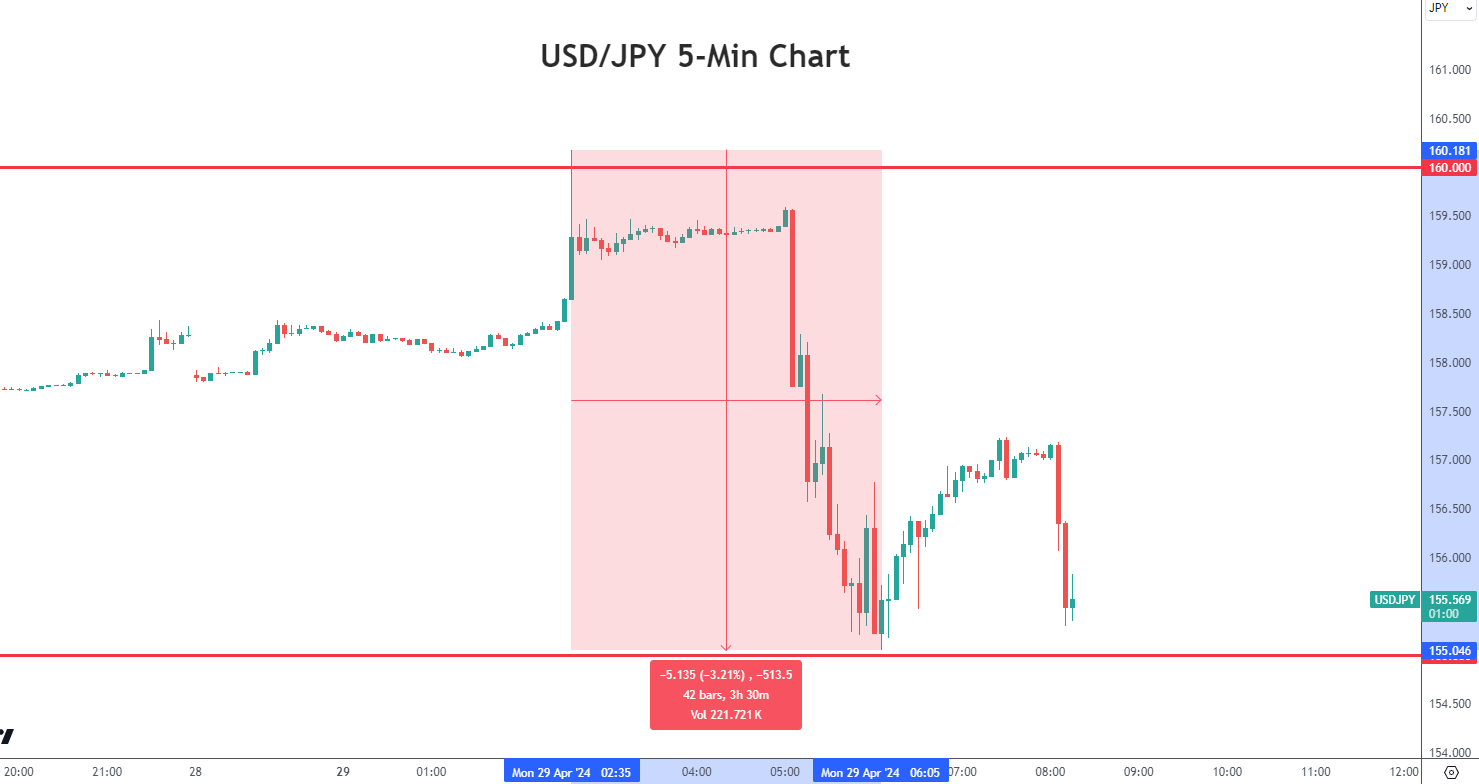

The USD/JPY pair plummeted from 160 to 155 as speculation of FX intervention emerged on Monday. This decline followed a disappointing Bank of Japan (BoJ) meeting where Governor Ueda suggested that the weak yen wasn’t impacting inflation significantly.

The Effectiveness of FX Intervention

Intervening in FX markets might provide a brief yen boost, but long-term yields and rates hold greater sway. Despite today’s decline, USD/JPY had been steadily rising due to favorable ‘carry trade’ conditions fueled by a 5%+ interest rate differential between the US and Japan.

Long-term Outlook and BoJ’S Stance

Even if Japanese authorities seek a stronger yen, traders may view dips in USD/JPY as buying opportunities. BoJ Governor Ueda’s remarks, indicating no urgency for rate hikes, contributed to the market’s dovish sentiment.

Upcoming Risk Events

The weekly chart illustrates a bullish trend, with 160 serving as a critical resistance level. A close below 155 today could signal further downside.

Market focus shifts to key US events: Treasury funding details on Monday, FOMC meeting on Wednesday, and Friday’s non-farm payrolls report. Concerns about economic growth, inflation, and interest rates weigh heavily on the Fed’s decisions amidst a complex economic backdrop.