USD/JPY Rises as Hot US Inflation Fuels Demand for US Dollar Amid Continued Buyer Interest

By Daniel M.

March 12, 2024 • Fact checked by Dumb Little Man

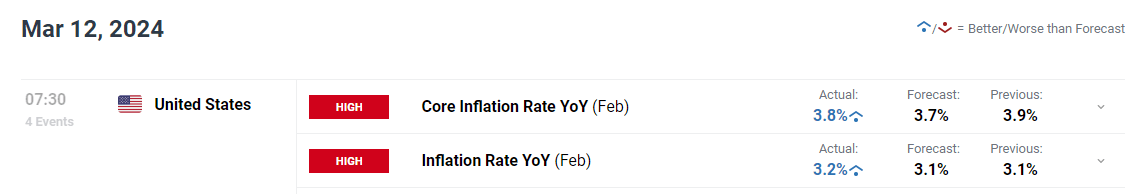

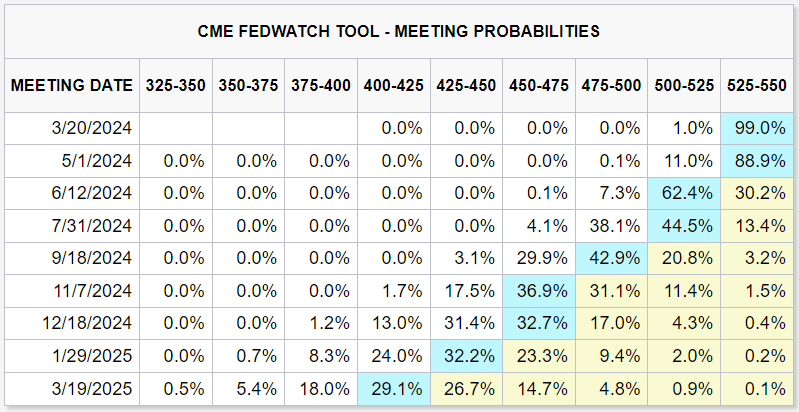

Following the announcement of the U.S. consumer price index (CPI) data for February, which exceeded forecasts, the USD/JPY pair saw a spike on Tuesday. The headline and core CPI both exceeded expectations, suggesting that inflationary pressures are significantly higher than pre-Covid trends and may postpone the first FOMC rate drop.

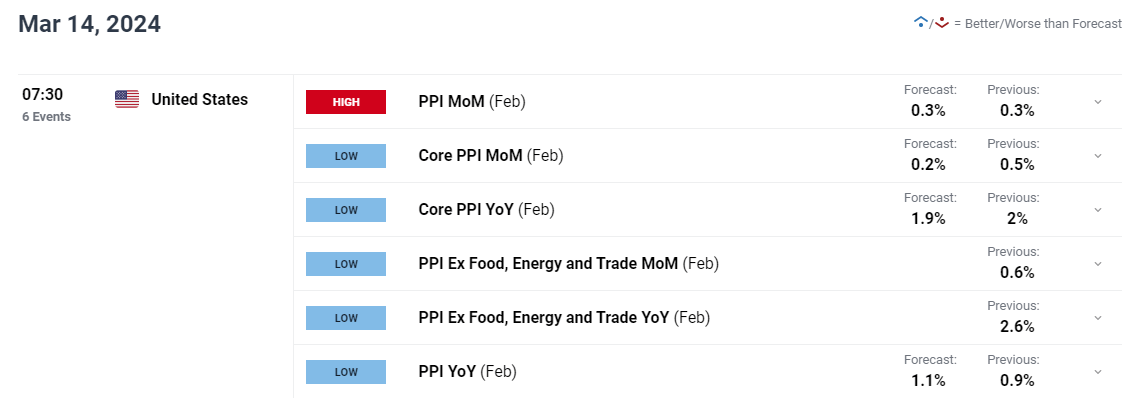

The Producer Price Index (PPI) data released on Thursday could encourage a hawkish repricing of interest rate expectations, driving up bond rates and the US currency notwithstanding market optimism.

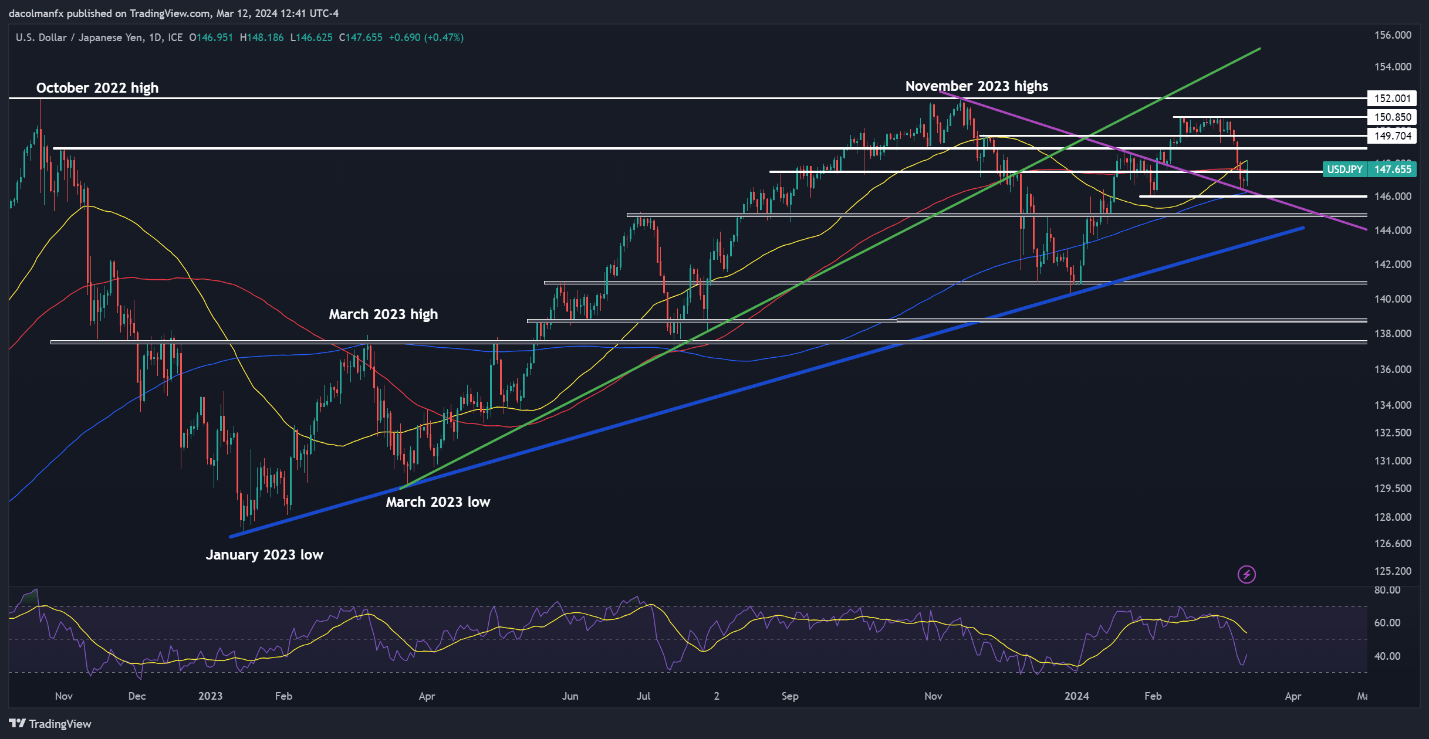

USD/JPY Technical Analysis: Poised for Upside Momentum

On Tuesday, the USD/JPY strengthened and surpassed the resistance level at 147.50. If this breakout is confirmed, there may be consolidation into 148.90 and a possible upside to 149.70. Motivated by favorable interest rate differentials, traders are actively purchasing dips while waiting for CPI data to determine the market outlook.

Interest rate dynamics sustain the market’s optimism notwithstanding recent pullbacks. The 50-day Exponential Moving Average (EMA) could be the goal of a break over 149.33, which could extend gains to 149.80.

If prices dip below 147.50, however, support might be found around 146.50–146.00, with ¥145 serving as a crucial milestone that suggests possible weakness. In the current market environment, value hunters are on the lookout for trading opportunities.

Final Thoughts

Strong CPI statistics caused the USD/JPY pair to rise significantly, indicating possible delays in FOMC rate decreases. The market may become more hawkish as focus turns to Thursday’s PPI data, supporting the value of the US dollar. Trading tactics are guided by the CPI data, which keep traders vigilant in the face of continuous volatility.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.