USD Price Action: EUR/USD, AUD/USD, USD/CHF Key Levels

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

Declining USD Amid Weaker Data

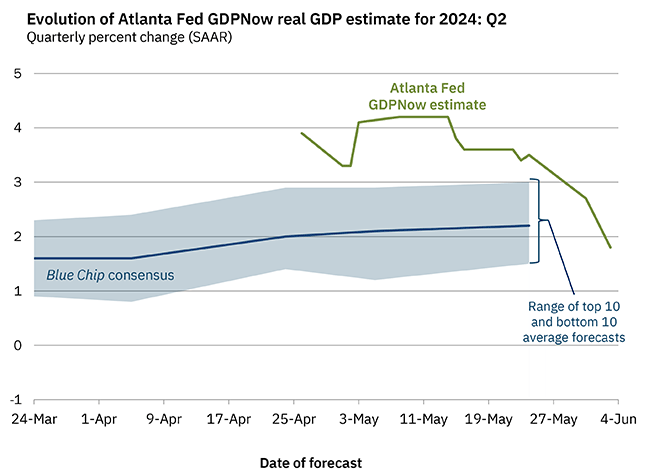

Economic data for the US shows a notable decline. Economic growth is slowing, as indicated by the Atlanta Fed’s GDPNow forecast, which dropped from over 4% to a mere 1.8% for Q2. This follows a disappointing Q1 growth of 1.6%, far below the expected 2.5%.

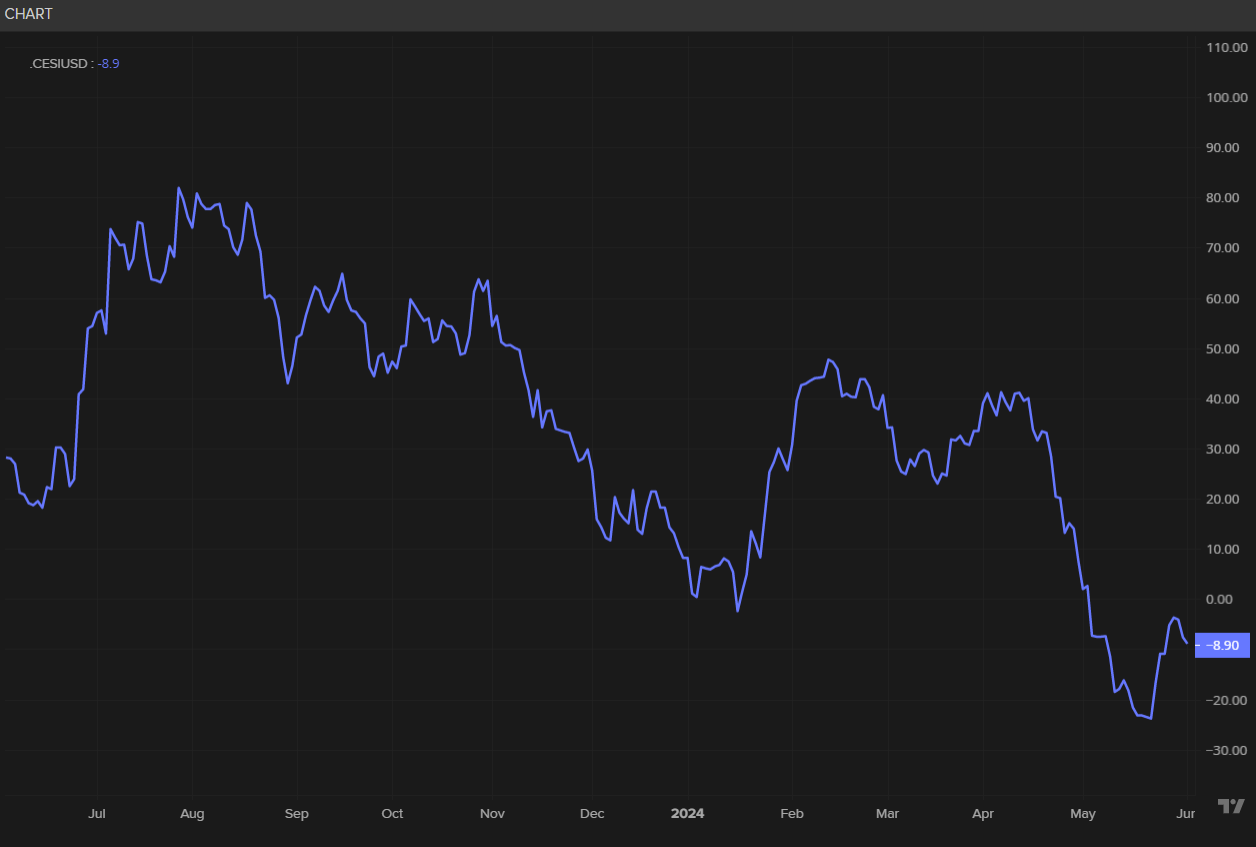

Additionally, April’s CPI and PCE inflation data suggest the disinflation trend is returning, providing some relief for the Fed as it plans the timing for lowering interest rates. Recent data, including the ISM manufacturing PMI survey, indicates weaker-than-expected results. The US economic surprise index has also continued its downward trend.

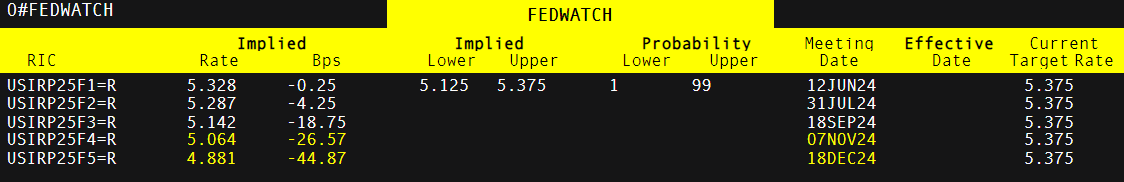

Markets are expecting at least one rate cut this year, possibly two. However, the timing is uncertain due to the upcoming elections, making September and December the most likely months for rate adjustments.

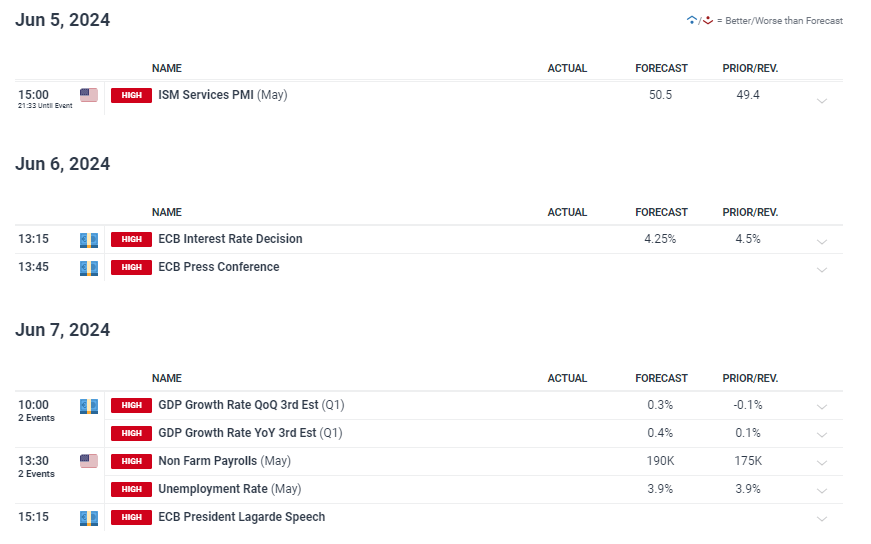

EUR/USD Eyes ECB Rate Decision

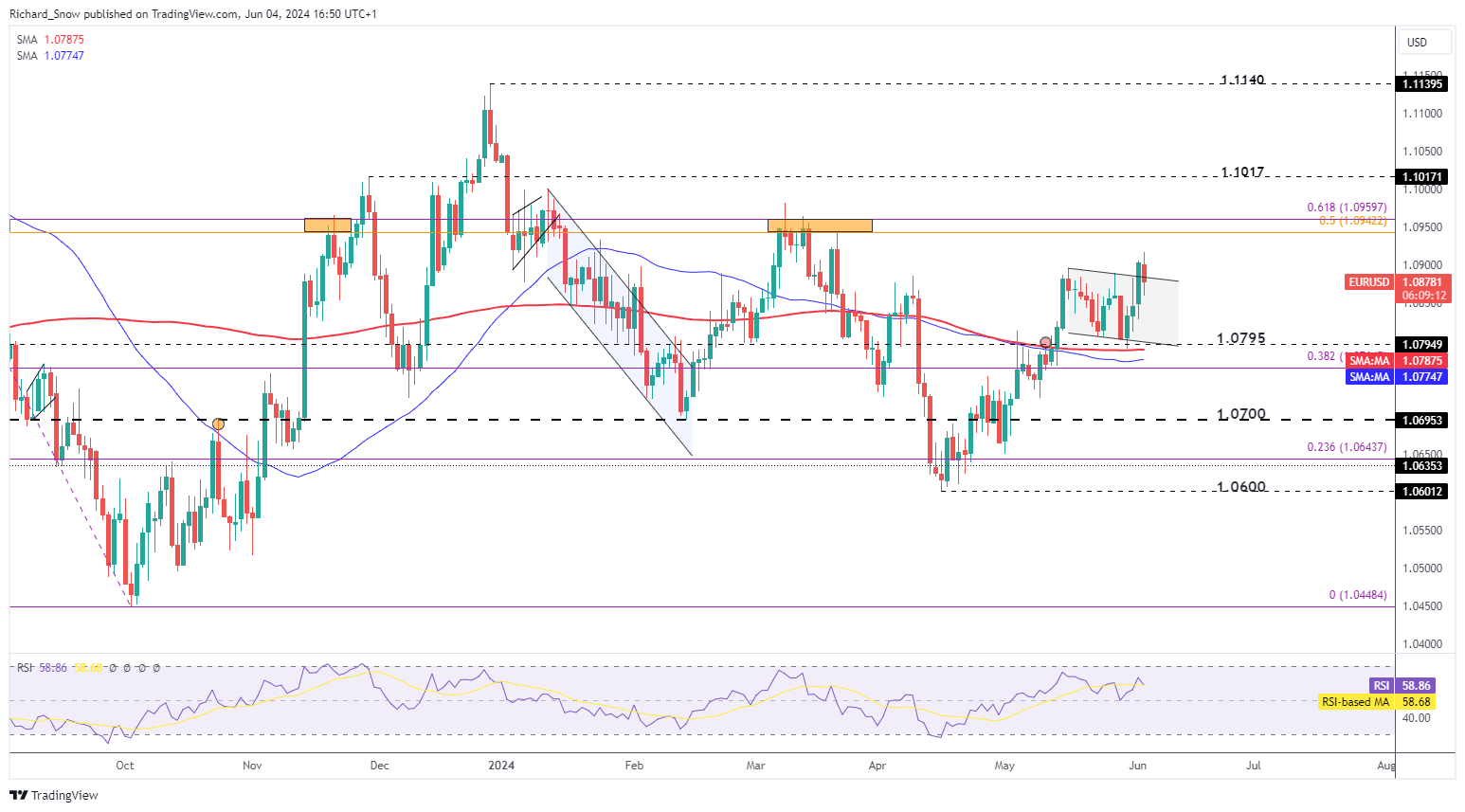

The ECB is preparing for its first rate cut after a period of rapid rate hikes. Market reactions might be muted, as many officials have already pointed to June as a likely date for rate reductions. The focus will be on the future path of rate cuts, though the ECB has communicated a cautious approach, avoiding the expectation of successive cuts.

EUR/USD has been attempting a bullish breakout, supported by softer US data. For a sustained move higher, US data needs to weaken further. A hawkish ECB cut could boost EUR/USD, though this is a challenging strategy. Downside risks for EUR/USD include a potential return to 1.0800 and channel support.

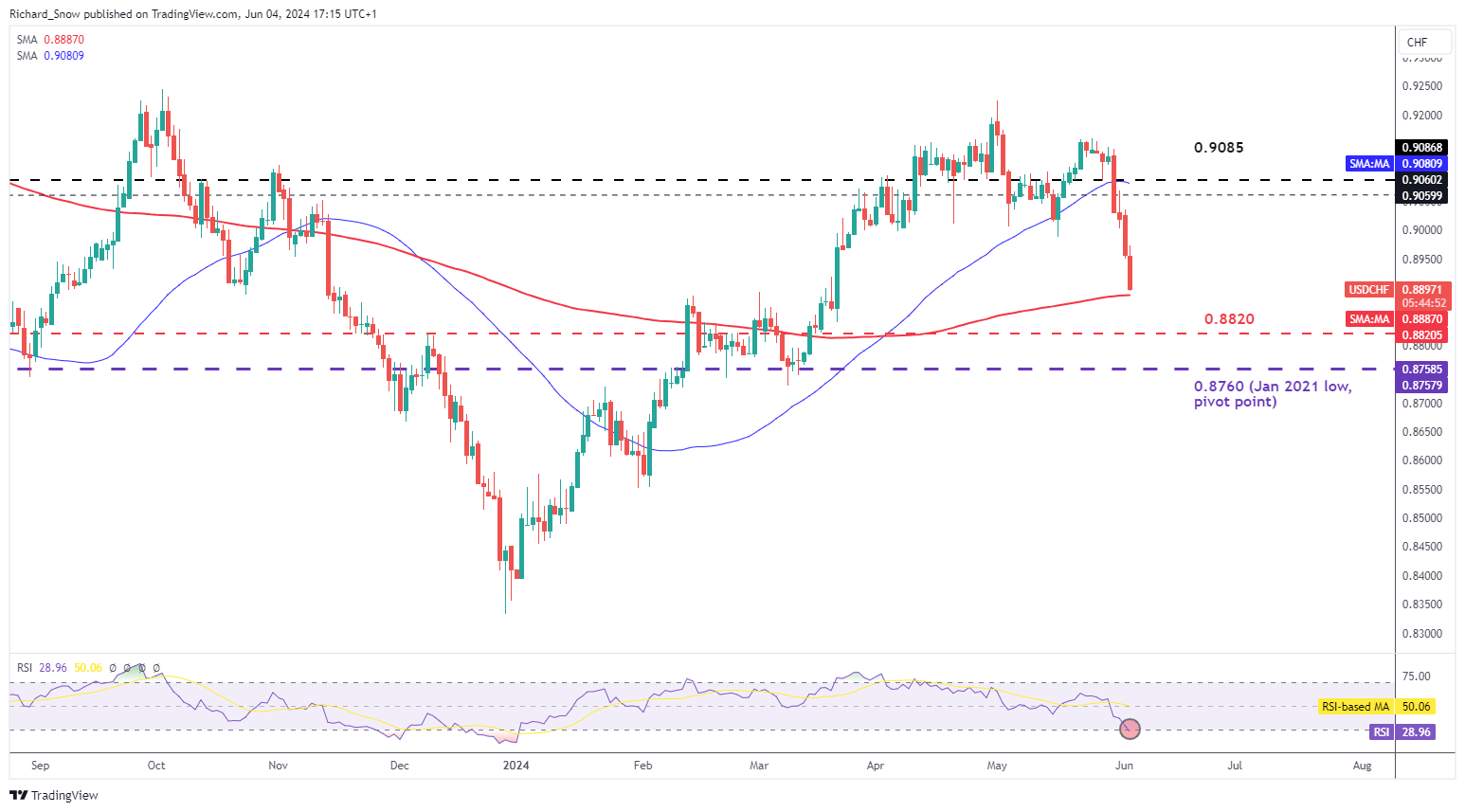

Swiss Franc Gains Despite Overheating Signals

USD/CHF has seen significant declines, with the 200-day simple moving average (SMA) and the RSI indicating oversold conditions. The Swiss franc has strengthened after comments from Swiss National Bank Chairman Thomas Jordan, who warned of the risks posed by a weaker franc to inflation. The SNB had already cut rates in March, leading to a depreciation against G7 currencies.

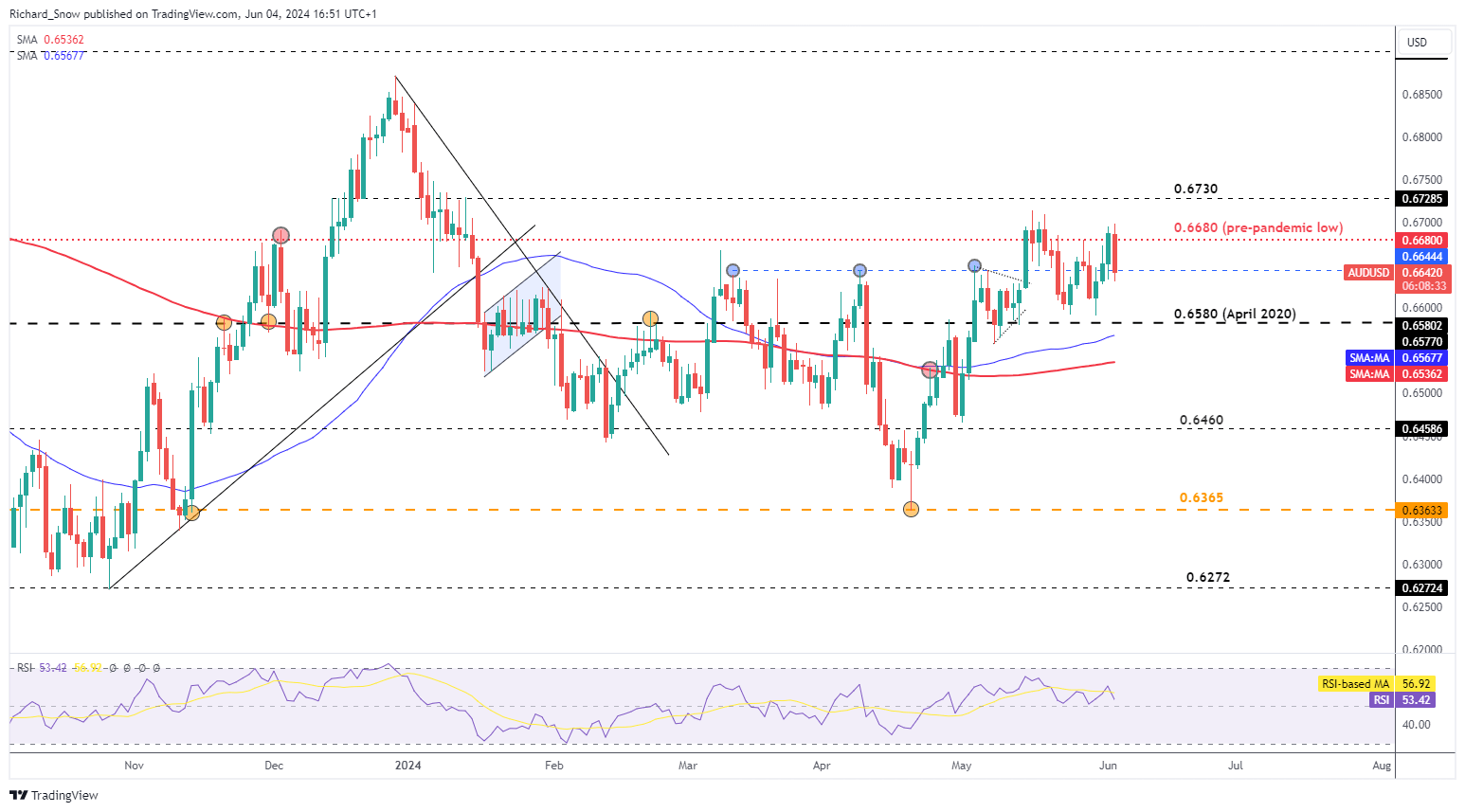

USD Bulls Target Lower AUD/USD Amid Weak Risk Appetite

In a stronger USD scenario, AUD/USD is worth watching. The Australian dollar might lose momentum as risk appetite declines. The currency often correlates with the S&P 500, which has started the week lower. This might be due to a cautious market ahead of Friday’s NFP data.

Metals, including gold, silver, copper, and iron ore, have seen declining prices. Iron ore, Australia’s main export to China, is facing reduced demand from the economic giant. AUD/USD failed to retest its recent high of 0.6714 and has since eased lower, with key levels at 0.6644 and 0.6580 in focus.

Key Upcoming Events

Upcoming US services PMI data will be crucial, with the ECB’s rate cut announcement on Thursday and the US NFP and average hourly earnings data on Friday being the main highlights.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.