The War On Grad School

By Brian Wallace

March 19, 2018 • Fact checked by Dumb Little Man

Now more than ever, an educated public is essential for a country to remain relevant and competitive in the global marketplace.

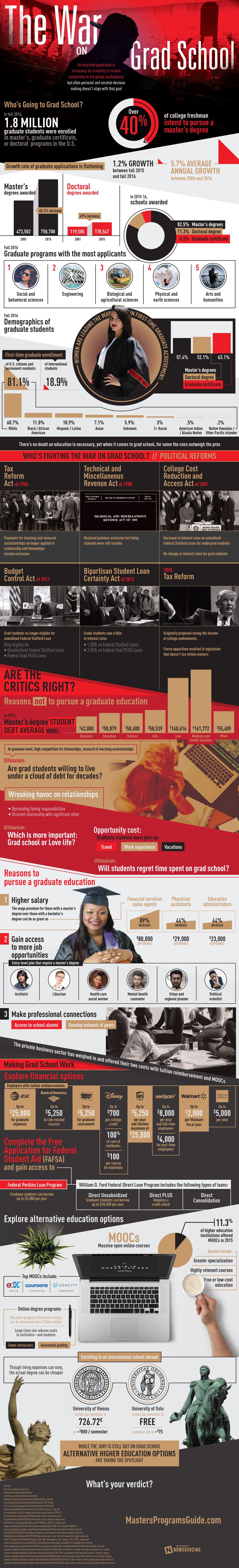

In fall of 2016, 1.8 million students were enrolled in master’s, graduate certification or doctoral programs in the US, showing a steady growth in enrollment in the last decade. Recently, however, that growth is starting to experience a decline.

Graduate programs with the most applicants (Fall, 2016)

- Social and behavioral sciences

- Engineering

- Biological and agricultural sciences

- Physical and earth sciences

- Arts and humanities

Are the critics right?

Making the most of our education has always been a part of the American dream. Today, however, students are even questioning the viability of getting a college degree in general as tuition rises, student loan debt balloons, and jobs remain scarce and low-paying.

No longer do students feel optimistic about the job market and many have opted to stick with a Bachelor’s degree and enter the workforce as quickly as possible.

While our parents and grandparents love to remind us about how they worked summers and even weekends to put themselves through college, that financial landscape is no longer our reality. For many students, the cost of pursuing a graduate education remains hugely prohibitive.

In 2012, the master’s degree student debt average ranged from $50,000 for education and science degrees and as high as $160,000 for law and health sciences degrees.

Average student loan debt by profession

- Business: $42,000

- Science: $50,400

- Education: $50,880

- Arts: $58,540

- Law: $140,620

- Medicine/Health Sciences: $161,770

Some students don’t see the increased student loan debt as a big deal when their potential salary options nearly double after completing their graduate degree. The wage premium for employees with a master’s degree over employees with a bachelor’s degree can be as great as 90% under the right set of circumstances.

Those holding Graduate degrees in the following fields can see a high difference in their wages:

- Financial services sales agents have an $80,000 increase in salary

- Physicians assistants have a $29,000 increase in salary

- Education administrators have a $23,000 increase in salary

For others, the looming debt isn’t worth the chance at a higher paying job and entering the workforce as quickly as possible is the only option. Even some entry-level jobs require a master’s degree and sometimes, graduates find that they can't afford to work in the field they went to school for.

See Also: Pay off Student Loan Debt by Going Back to School

Some of the common entry-level jobs requiring a Master's Degree or higher include:

- Librarians

- Mental health counselors

- Healthcare social workers

- Political scientists

- Urban planners

While grad students work towards their degrees, their years spent in school are still years spent outside of the workforce. Some would say this puts these students at a professional disadvantage, especially when employers are generally more interested in work experience and skills rather than a prestigious degree.

Grad students may experience:

- Fewer options to network with professionals

- Less time and fewer opportunities to build work experience and resume while in school

- Fiercely competitive job market of other workers with more experience and “less” education

The case for grad school

Despite its reputation for being expensive, there are countless financial options to make grad school work. Many employers, especially big name brands, offer incentives, and tuition reimbursements for their employees.

Some of the best tuition assistance in the market includes:

- AT&T offers up to $25,000 for graduate expenses

- Bank of America offers up to $5,250 for job-related courses

- Disney covers up to $700 per college credit and covers 100% of the cost of textbooks

- FAFSA is also a good option for those looking to expand their education without breaking the bank. Opening up access to federal loan programs designed just for graduate students, these financial options help to make grad school more accessible and realistic for students.

The Federal Perkins Loan Program allows graduate students to borrow up to $5,000 per year. Direct unsubsidized loans can give graduate students access to borrowing up to $20,000 a year.

More than 40% of college freshmen say they intend to pursue a master’s degree, but the number of students enrolling in graduate programs is beginning to flatten out. With a growth rate of 1.2% from 2 to 15 to 2016, compared to the 5.7% average annual growth rate between 2006 and 2016, fewer students are taking on grad school.

What’s keeping students from furthering their education with grad school? Check out this infographic to learn more about the war on grad school.

Source: Masters Programs Guide

Brian Wallace

Brian Wallace is the Founder and President of NowSourcing, an industry leading infographic design agency based in Louisville, KY and Cincinnati, OH which works with companies that range from startups to Fortune 500s. Brian also runs #LinkedInLocal events nationwide, and hosts the Next Action Podcast. Brian has been named a Google Small Business Advisor for 2016-present and joined the SXSW Advisory Board in 2019.