What is Forex Scalping – In Depth Review

By Wilbert S

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best forex broker for traders is Avatrade

The #1 Forex Trading Course is Asia Forex Mentor

Believe it or not, the global forex market reached a total worth of $2.409 quadrillion in 2021. This not only shows the prime time to involve in forex trading but also highlights the growing demand and rapid progress within the global financial markets. COVID-19 had some serious repercussions like a high risk of losing money for those who wanted to conduct investment business but it is also evident that the market is now showing prominent progress. Traders interested in the forex market are rapidly moving back to brokers and securities exchanges to invest a massive amount of money.

Whether you are planning to step into the forex market or are still scratching the surface to make profits, this review has got all that you need to know about how professional traders are taking advantage of the forex scalping strategy, best scalping approaches, its pros and cons, and resourceful study material that can help you to explore, learn, and practice different trading styles.

What is Forex Scalping

Forex scalping is one of the styles of forex trading which involves making profits by trading short-term price swings that occur in the forex market. Scalpers usually hold their trades for a very short duration ranging from a few seconds to minutes before closing them. Most scalpers prefer to trade on lower time frame charts because of the short-term nature of the trades. To scalp successfully, traders analyze the Forex market on various time frames and come up with speciation about the likely market direction. They then take short-term trades (known as scalp trades) profiting from small price movements in line with this speculation.

Forex scalping usually results in a series of small profits which add up to a larger sum. Scalping requires ‘quick fingers’ and thought processes. In volatile market conditions, scalpers make a profit by buying and selling a currency once their trading criteria are met. This requires a trader to quickly analyze the Forex market and make trading decisions swiftly. Due to the nature of scalping, it’s important to learn the best time to enter and exit trades. Unlike long-term forex traders, forex scalpers rely heavily on technical analysis to guide their trades and help them decide the best entry and exit points.

Scalping forex successfully may also depend on a trader’s personality traits and needs. Scalpers are very fluid in terms of making trading decisions. They can change their biases easily and adapt to the rapidly changing market environment. To improve the efficiency of their fast-paced trading methods, forex scalpers sometimes employ trading robots to help them carry out some trading processes. These robots can analyze the Forex market, execute and manage trades. These robots can be used on several trading platforms like MT4 and MT5 to help create a stress-free trading environment when scalping forex.

Forex scalping strategies can produce trading profits compared to other styles of trading. Even though the trades are held for short periods, the profits can be maximized through the use of high leverage and appropriate position sizes. In forex trading, scalpers may open larger contract sizes (or lot sizes) compared to other types of traders, but still, use proper risk management to control the losses. This can be done by defining the risk percentage per trade before executing trades. To open larger lot sizes, forex scalping sometimes requires traders to use high leverages in their retail investor accounts. Most times, scalpers rely on market volatility to make the best out of their trading systems. This volatility can be gotten by trading in the volatile trading sessions or during the release of news and fundamental data. This creates price displacement that scalpers can profit from.

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Avatrade website |

How Can I Scalp Forex

To make profits from forex scalping, you need to;

#1. Learn a trading strategy

#2. Create a trading plan

#3. Select a broker

#4. Fund your account and trade.

Learning a trading strategy is the first step to trading the forex market successfully, regardless of the trading style being employed. There are different trading strategies that can be employed by scalpers to carry out technical analysis in the forex market. A Forex Scalping strategy is essential for any scalper who seeks to make consistent profits.

Some of the strategies include the use of indicators, trading robots, or tools of technical analysis like support and resistance and theories of supply and demand, smart money concepts, etcetera. Some of the popular indicators used by traders are; Relative Strength Index (RSI), Moving averages, Bollinger bands, and Moving average convergence divergence (MACD).

Support and resistance zones are areas where price has turned or changed direction in the past due to an increase in the number of buyers and sellers at those price levels. Indicators are technical analysis tools that help forex traders make decisions on when to enter or exit trades, and when to stay out of the forex market. Forex scalpers can use indicators to analyze the market and trade currency pairs – both minor and major currency pairs. Indicators like moving averages are used by forex scalpers to predict and confirm a change in the market trend.

After learning a forex scalping strategy, a trading plan is needed to help create trading rules for scalp trades. The trading plan consists of a trading strategy and trading rules that guide how the scalping strategy is applied. The trading plan can specify the risk management parameters, the timing of trades, and the courses of action to take in certain scenarios.

This ensures that the forex scalping strategy is developed into a rule-based strategy that produces consistent returns. Having rules specified in a trading plan ensures that trading results in retail investor accounts are reproducible. This is important because forex scalping strategies are bound to have losing trades – following a trading plan ensures that the wins are enough to mitigate losses.

The most important part of a trading plan is the risk management rules. Poor risk management is the main reason why new forex traders are prone to losing money rapidly while trading cfds and scalping the Forex market. Proper risk management allows traders to explore the full potentials of their scalping trading strategies while developing a solid trading psychology.

After creating a trading plan, you need to select a forex broker and open a live or demo trading account to start scalping forex. A forex broker provides a trading platform for traders to buy or sell currency pairs – minor and major currency pairs. This makes currency trading possible since the broker acts as a middleman to match buy and sell orders thereby facilitating forex trading. Here are the 4 Best Forex Brokers we recommend.

| Broker | Best For | More Details |

|---|---|---|

| Advanced Non US Traders Read Review | securely through Avatrade website |

| Intermediate Non-US Traders Read Review | securely through FXCC website |

Overall Broker | securely through Forex.com website | |

| Professional Forex Traders Read Review | securely through Interactive Brokers website |

A live or demo account can be opened depending on the needs of the trader. An experienced trader who has a profitable trading system can take scalping trades on a live account while new traders are often advised to trade with a demo account to avoid losing money rapidly on a live trading account. While choosing a forex broker for scalping, you should choose a broker with favorable (low) spreads and commissions. You may also need to check out the currency pairs and forex indicators that are compatible with a specific forex broker.

New traders whose retail investor accounts lose money can use automated trading software to trade forex. This is because automated trading systems have forex scalping indicators and strategies to help make forex scalping profitable. Forex robots can also be used to copy trades executed by experienced traders.

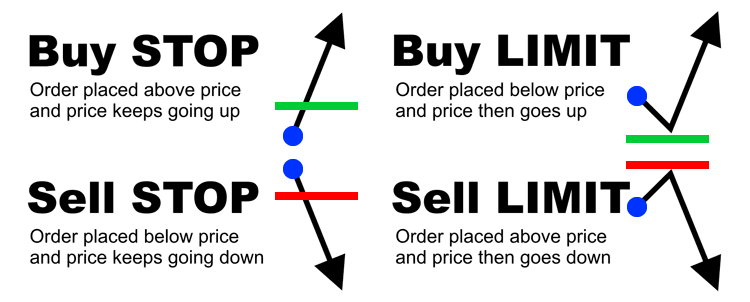

After registering with a broker, you can take scalp trades by executing them on the broker’s trading platform. Trades can be executed using various techniques; market execution and pending orders. A market execution order is one in which a trade is opened at the current market price. Pending orders are orders that instruct the broker to activate an order once the forex market trades to a specific price point. After placing a pending order or market execution trade, a stop-loss order should be placed to control losses. A stop loss is a price point at which a trade order is closed on your behalf. Stop losses are great risk management tools that prevent drastic drawdowns and total loss of deposited funds.

Scalp trades are executed when trade signals or setups are presented by technical indicators or forex trading software. As a new trader, you can practice trading on a demo account for a while. This helps you understand how to use these trading platforms. After sufficient experience trading on a demo account, you can create a live account and fund the account using multiple payment methods offered by brokers. It’s also important for a forex scalper to use high leverage that allows appropriate position sizing, so ensure your leverage is enough to meet your trading needs.

Pros and Cons of Forex Scalping

No matter which forex trading style and strategy you choose, it is highly important to watch out for the pros and cons especially if it is about forex scalping. Therefore, new traders should know the following things before they start trading:

Pros

- Scalping trades bring fast and easy returns with multiple trades per day.

- Successful scalping earns small profits but with a reduced risk of losing money rapidly.

- Scalping in forex is easy to start and traders can understand the forex market quickly.

- Scalping techniques rely on technical analysis of minute-by-minute price movements.

Cons

- Scalping strategy requires higher leverage that top brokers already offer to the traders.

- Scalping trades are riskier if you fail to cut losses immediately, so just keep a closer look.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Conclusion: What is Forex Scalping

Finally, scalping is one of the many trading styles used by forex traders to make profits. It is best suited for traders who love fast-paced trading techniques that generate small profits quickly. Successful scalping requires patience and the ability to respond quickly to the changing market environment. Like other styles of trading, scalping requires technical and fundamental analysis to forecast price movement. Technical analysis can be done using various tools of analysis in order to determine the best point to enter or exit trades.

To make profits from scalping, traders need to learn how to carry out technical analysis on multiple time frames, then create trading rules to improve the reliability of the trading strategy. Scalpers who find it difficult to make consistent profits can trade with expert advisors that provide trading signals, or copy trades of professional traders using copy trading software.

Scalping the forex market is a great way to make profits and compound an account. To be a successful scalper it is important to create a trading strategy and a trading plan. Before engaging in scalp trades, ensure the trade setup fulfills the rules you have outlined. This helps to create healthy trading habits, consistent profitability, and a scalping system that works!

Best Forex Trading Course

It is highly important to choose the one that not only incorporates the fundamentals of the forex market but encompasses views and guidelines by an accomplished leader like Ezekiel Chew who is the founder of Asia Forex Mentor. It is one of today’s most renowned online learning platforms that offers a comprehensive trading program titled ‘The One Core Program’. It covers everything from the basics of Forex to competing with top forex traders. From beginners to experienced traders, this course is perfect for everyone who wants to make huge profits by trading forex currency pairs and CFDs.

It gives detailed insights into the fundamental analysis, technical analysis, expert trading strategies, investment advice, forex indicators, trading signals, and in-depth knowledge about the various ins and outs that one should remember to avoid high chances of losing money. From creating a demo account on a trading system to trade in the forex market to applying advanced trading styles and roadmap to success, the course has got all that you need to know and become a successful trader overnight in today’s competitive forex market.

Available to subscribe for just $940, The One Core Program is an all-in-one learning package to grow your portfolio from zero to a million dollars in just a few days. What’s more interesting is that Asia Forex Mentor allows people to start learning the course without paying for it. It offers 7 days of free classes and then asks the candidate to continue the program if they found it helpful and interesting. In addition to this course, Asia Forex Mentor also offers a free online training course titled “5 Part System To Make Really Big Money in Trading”.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

What is forex Scalping FAQs

Is trading scalping illegal?

Scalping is not illegal. It is a legal trading style used by lots of professional traders around the world. It helps them make profit by trading short-term price displacements using different scalping techniques and strategies.

However, some scalping strategies may not be permitted by a forex broker or prop firm. For example, some prop firms and brokers do not allow tick scalping or martingale scalping strategies.

Is scalping profitable forex?

Yes, scalping forex can be profitable of it is done right. Scalping is just as profitable as long-term trading strategies. Even though trades ads typically held for a short duration, they can be used to make remarkable returns with the appropriate risk management and position sizing.

Also, the trading strategies used by scalpers are mostly similar to those used by long-term traders – the main difference is the trading time frame in which these strategies are applied as well as the duration of the trades. This means that profitable trading strategies that are developed by experienced traders can be used to scalp the forex market by applying them to lower time frame forex charts.

How does scalping work in forex?

Scalping is simply a trading strategy that helps traders profit from short-term price displacements in the forex market. It can be done by analyzing the market using indicators and other technical analysis tools, then executing trades in line with the trader’s bias. Scalpers do not hold on to trades for long periods but only profit from small price movements. This allows scalpers to make small profits that amount to sizable returns when compounded.

Wilbert S

Wilbert is an avid researcher and is deeply passionate about finance and health. When he's not working, he writes research and review articles by doing a thorough analysis on the products based on personal experience, user reviews and feedbacks from forums, quora, reddit, trustpilot amongst others.