Yen Gains Momentum: Understanding the Market Dynamics

By Daniel M.

July 24, 2024 • Fact checked by Dumb Little Man

The Yen Gains More Ground Against the Dollar

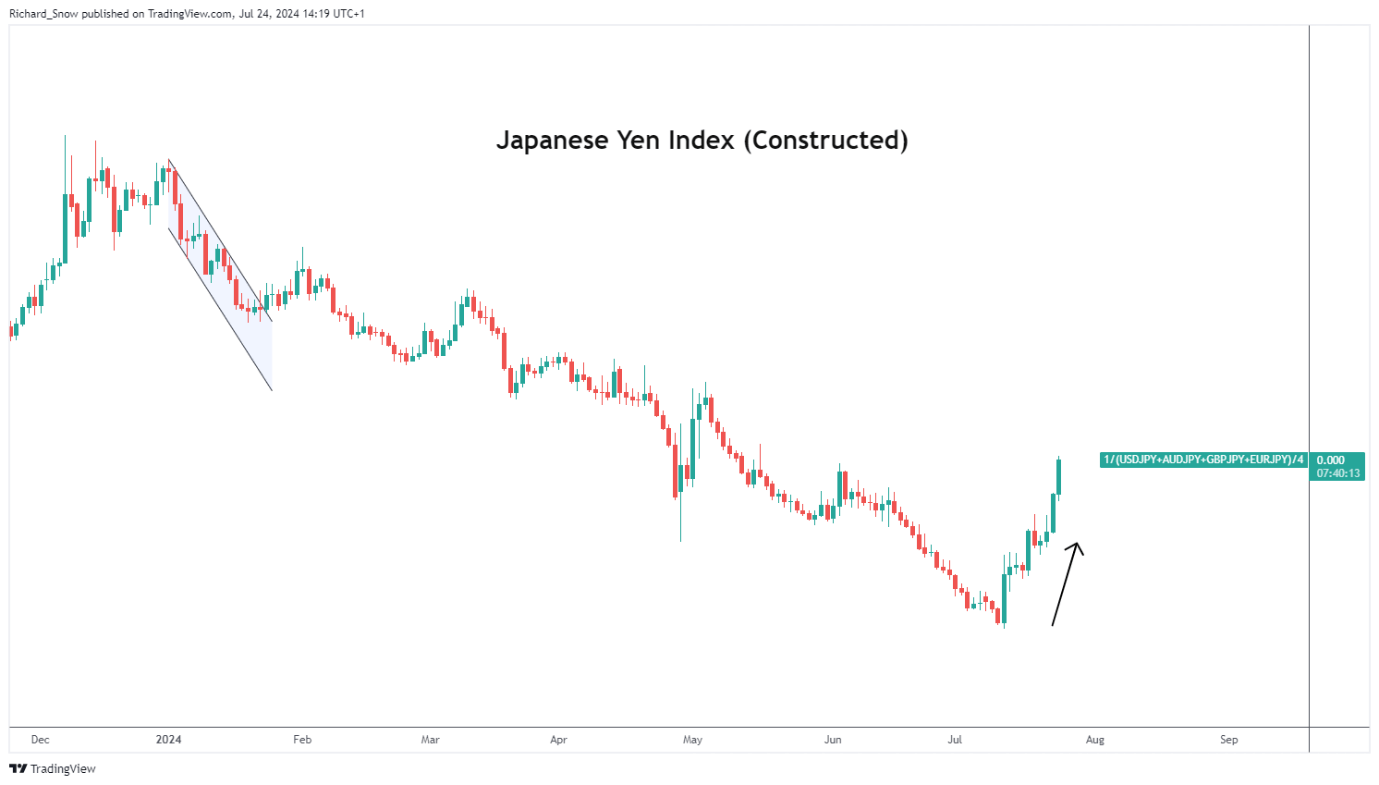

The Japanese yen appreciated against a basket of major currencies on Wednesday, one week before the highly-anticipated Bank of Japan (BoJ) meeting. In their June meeting, the BoJ indicated that details about reducing their balance sheet would be released at the end of this month, following last month’s market disappointment.

Japan is gradually moving towards policy normalization, with expectations to hike rates to a neutral level (estimated between 0.5% and 1.5%) while balancing encouraging inflation data against lackluster consumption data.

There is optimism that reduced taxes and higher wages will boost local consumption and household sentiment enough to consistently breach the 2% inflation target.

USD/JPY Technical Analysis

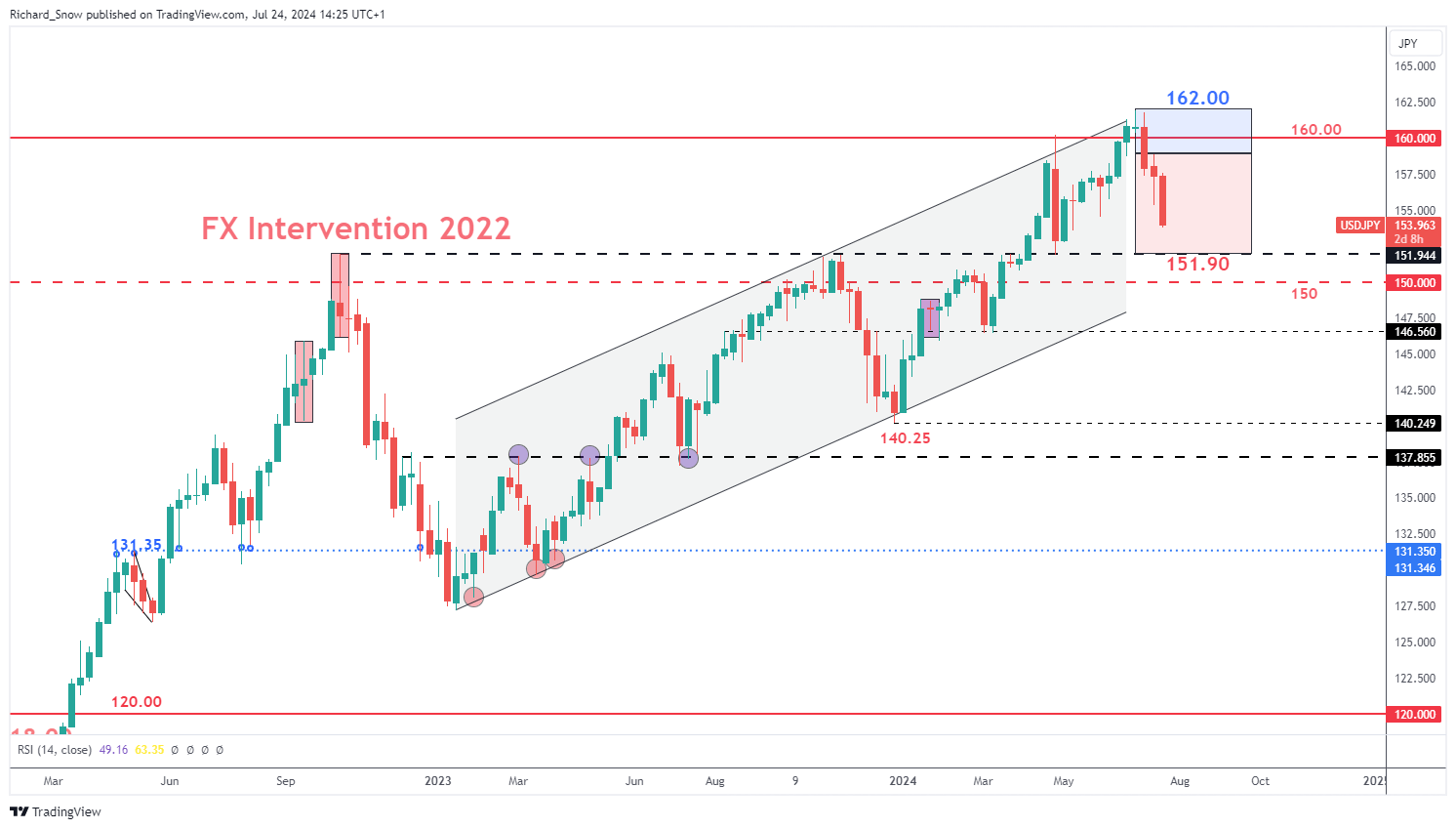

The weekly USD/JPY chart outlines the anticipated Q3 trading range, showing an initial upward drift at the quarter’s start, followed by a significant downward move as the yen recovers previous losses. The next crucial level is the 151.90 support level, marking the moment Tokyo intervened in the FX market in 2022. For a detailed analysis of the factors influencing the yen, refer to our comprehensive Q3 forecast:

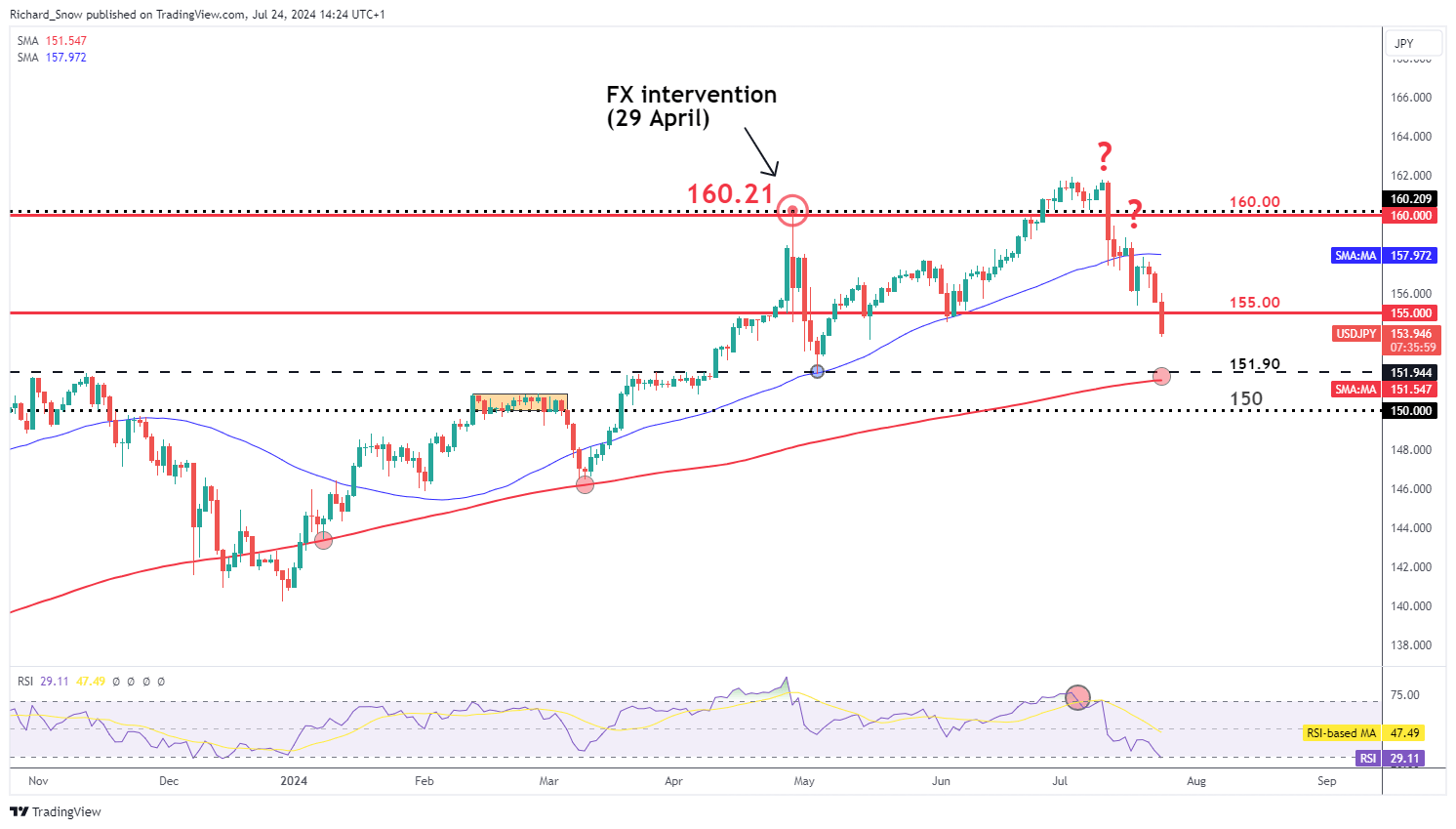

The daily USD/JPY chart depicts the yen’s recent progress, supported by a weaker US dollar and suspected FX intervention by Japanese officials. Markets have been caught off guard by mass yen purchases following positive news like lower-than-expected US inflation, contrasting with previous reactionary purchases after negative news such as hotter-than-expected US inflation or economic growth.

The daily chart reveals oversold conditions that indicated a short-term bearish reversal, which materialized as the pair moved lower, hitting the 160.00 and 155.00 markers.

This week’s US PCE data might extend this movement if inflation surprises to the downside. However, a print in line with expectations may continue the general move at a slower pace. The 151.90 and 150 levels are the next support levels, with the 200-day SMA in between – presenting the next major test for yen bulls.

BoJ to Assess if Weak Consumption Will Delay Inflation Target

Next Wednesday, the BoJ will decide if recent lackluster consumption figures will impede the committee’s inflation goal. Markets predict a 62% chance of a 0.1% rate hike to move slightly towards the neutral rate. The Bank will also detail plans to reduce its balance sheet by decreasing the quantity of Japanese Government Bonds purchased each month. Previously, the BoJ aimed to contain government borrowing costs to stimulate the economy through fiscal spending initiatives. With inflation and wages trending upwards, the Bank can now allow yields to rise. Higher yields typically lead to currency appreciation, especially against currencies linked to central banks currently in a rate-cutting cycle.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.